Introduction

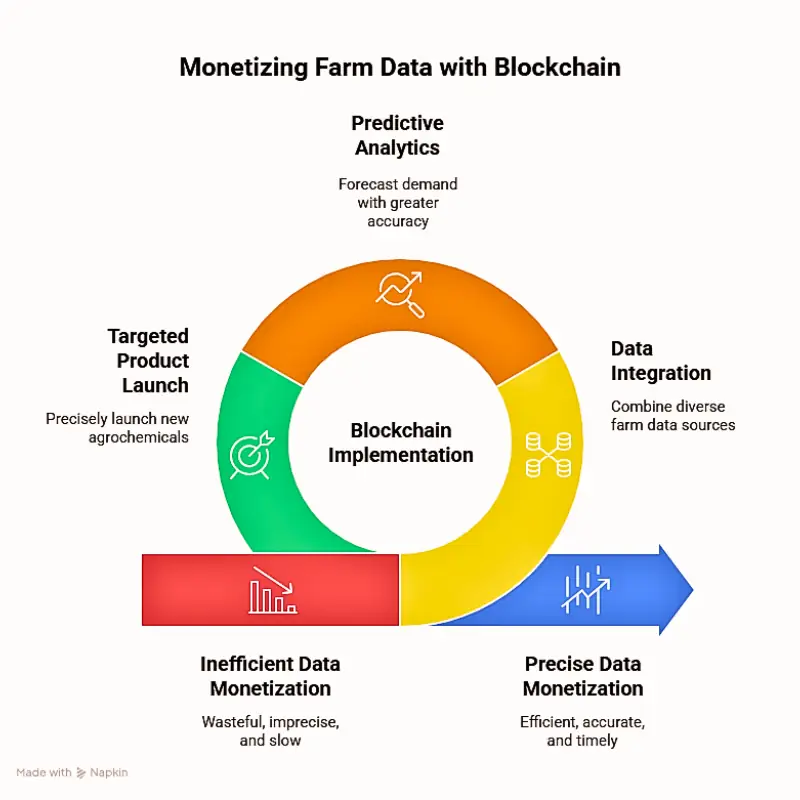

Farmers have always sold their harvest, a tangible product exchanged in a single transaction. But what if they could repeatedly monetize farm data blockchain to sell something invisible yet incredibly valuable to countless buyers?

Imagine turning each pesticide application, soil test, or weather record into a digital asset as tradable as gold. This article examines how blockchain technology can enable farmers to instantly monetize their agricultural data, thereby unlocking a new revenue stream and shaping the future of farming.

How to Monetize Farm Data with Blockchain Scanning

Let’s look at a farmer who has just finished spraying crops. Traditionally, the value of this task is considered complete once it is finished. But today, the farmer is turning this ordinary farm activity into an extraordinary digital asset, monetizing detailed agricultural data.

After spraying, the farmer opens a user-friendly app on a smartphone or tablet. With a simple photograph of the pesticide container, crucial details such as the product name, batch number, manufacturing date, and expiry date are instantly captured and processed by the app.

OCR: Turn Labels into Blockchain-Monetized Data

To make data input even easier, the platform should use smart label recognition powered by OCR (Optical Character Recognition).

When a farmer snaps a photo of a pesticide, fungicide, or fertilizer label using their smartphone camera, the app automatically reads and extracts key details such as: Product Name, Batch Number, Production Date, Expiry Date, Manufacturer Info.

These details are instantly converted into text and auto-filled into the relevant fields. This drastically reduces manual entry, prevents typing errors, and enhances data credibility, making the dataset more appealing to prospective buyers.

After all, if you just finished an extensive spraying operation, collected and stored/disposed empty containers, cleaned spraying equipment, and are feeling tired after a long working day, you would not necessarily want to spend another 30-40 minutes fiddling through the app trying to correctly spell ” Chlorantraniliprole” for the 5th time while getting an “incorrect” response.

User experience (UX) should be intuitive, simple, and guide the end user (who may not be the tech person) into the next logical step.

By reducing friction and improving precision, smart scanning transforms a simple photo into a high-value data asset.

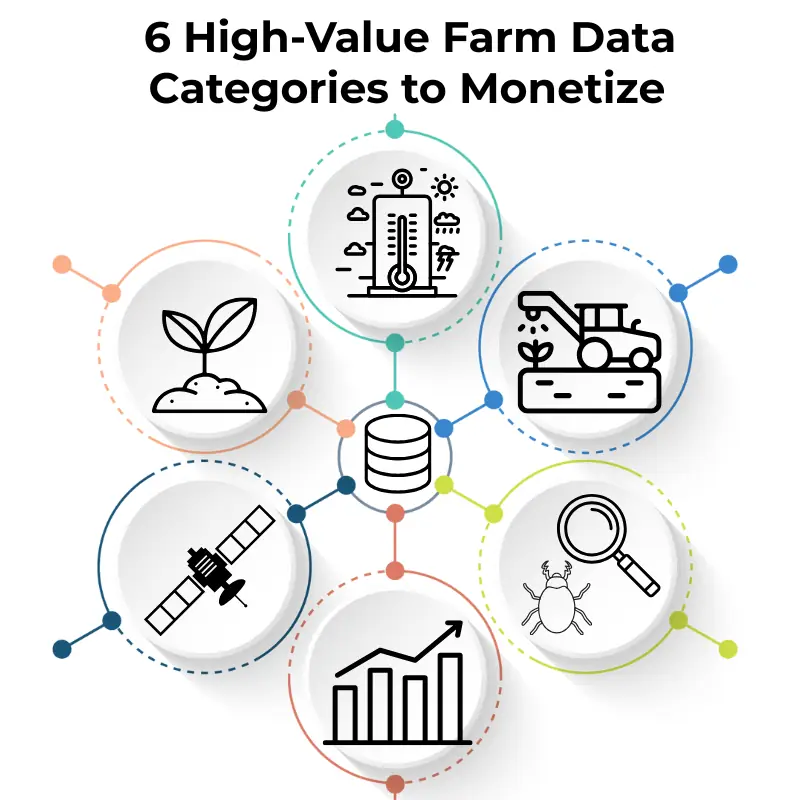

6 High-Value Farm Data Categories to Monetize

The farmer then adds further valuable data, significantly enriching its market value. By providing these carefully categorized data points, the farmer essentially creates an extremely valuable, refined digital “product” that buyers further upstream leverage for profitability.

These include, (but as lawyers like to say, “are not limited to“, as the app needs to be flexible for further data additions, such as homemade fertilizer remedies and veterinary/animal production in mixed farms):

Farm & Crop Information

Treated farm area, crop variety, seed type (hybrid/heirloom), growth stage, compliance certifications (Organic, GLOBALG.A.P.)

Environmental Conditions

Weather history (previous 3 days), exact weather during application, soil test results, or observational data (moisture, pH, nutrients, organic matter)

Application & Equipment Details

Pesticide/fertilizer names, application rates, tank-mix specifics, exact date/time of spraying

Equipment type and capacity (e.g., knapsack or tractor-driven), age, calibration, maintenance status, energy consumption (fuel type and efficiency)

Crop Health Observations

Photos or notes on pests, weeds, diseases, crop abnormalities, vigor, and overall health indicators triggering treatments

Precision & Historical Performance

GPS coordinates, drone/satellite imagery, NDVI data

Historical yields, previous pest/disease management practices, past disease/pest outbreaks, and economic losses from prior seasons

Economic & Market Insights

Costs of inputs (seeds, fertilizers, pesticides), labor hours, machinery use, and profitability per crop cycle

Market destinations for crops, historical pricing, contract terms, and personal farmer insights (practical observations, best practices, effectiveness of treatments)

Once submitted, this structured data is securely anonymized, embedded into the blockchain, and instantly becomes available for interested buyers, enabling immediate cryptocurrency payments directly to the farmer.

Upon submission, the farmer logs into a secure blockchain-enabled trading platform. Immediately, a smart contract activates, securely anonymizing and embedding this comprehensive dataset into an immutable blockchain.

Buyers, including agrochemical companies, agricultural researchers, commodity traders, insurance providers, technology companies, and governmental bodies, can browse, filter, and purchase datasets specifically relevant to their needs.

Every transaction instantly triggers an automated cryptocurrency payment directly to the farmer, creating immediate financial rewards and turning everyday farm operations into ongoing revenue streams.

Buyer’s Journey: Finding the Perfect Dataset

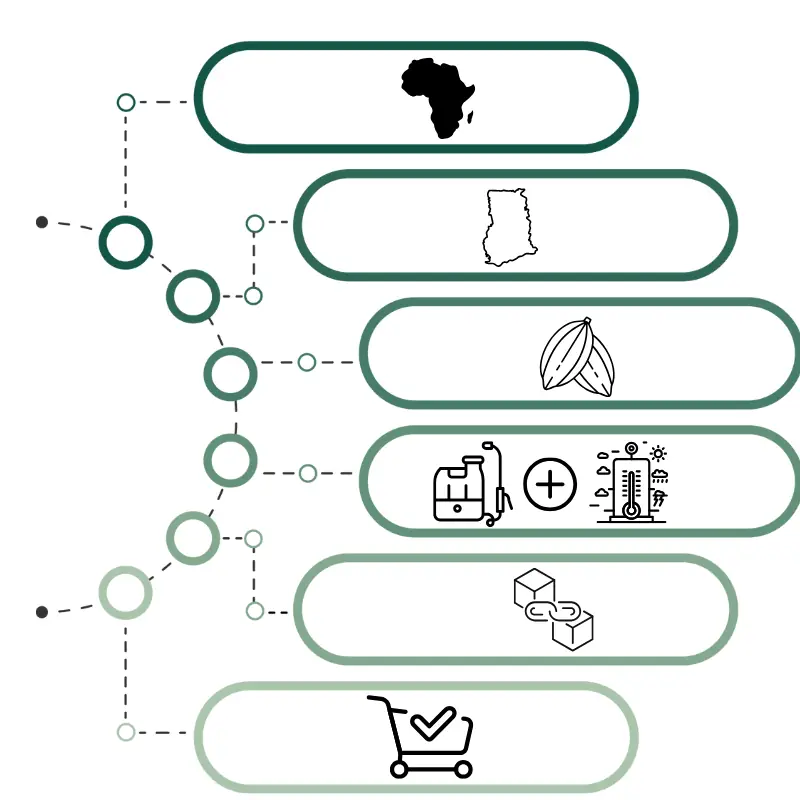

Imagine you’re a cocoa trader at a multinational firm. You need rainfall and pesticide data from smallholder farms in West Africa to predict next season’s yields. Here’s how you’d use the platform’s filters:

Data “Shopping-Friendly” Experience by Filtering

Accessing the Farm Data Marketplace

You log into the blockchain-based agricultural data marketplace—a digital storefront similar to Amazon, but for farm data. The homepage displays trending datasets (e.g., “Maize Soil Health in Brazil” or “Cotton Irrigation Trends in India”).

Primary Filters — Getting the Basics Right

You start broad, using primary filters to narrow your search:

Region: Select “West Africa” → Further drill down to “Ghana” or “Côte d’Ivoire.”

Crop Type: Choose “Cocoa.”

Data Type: Pick “Pesticide Application” and “Weather Data.”

Instantly, the platform shows datasets like:

“Pesticide Spray Records (Knapsack) + Rainfall Data: Cocoa Farms, Ghana, 2026”

“Soil Moisture & Fungicide Use: Smallholder Cocoa Growers, Côte d’Ivoire”

Secondary Filters — Zooming In on Specifics

Next, you get granular with secondary filters:

Time Range: “Last three growing seasons” (to analyze trends).

Equipment Type: Select “Knapsack Sprayers” (common among smallholder farmers).

Environmental Conditions: Filter for “High Rainfall (>1500mm/year)” or “Humidity >80%.”

Data Granularity: Choose “Raw Data” (for your team’s AI models) or “Pre-Analyzed Trends” (for quick insights).

Previewing & Validating Dataset Quality

You click on a dataset titled:

“Knapsack Pesticide Efficacy in High-Rainfall Cocoa Farms (Ghana, 2026)”

The platform lets you preview:

Sample Data: A snippet showing anonymized pesticide types, application rates, and rainfall correlation.

Metadata: How many farms contributed data (e.g., “1,200 anonymized entries”), average farm size, and blockchain verification stamps (proving the data is untampered).

Farmer Credibility Score: A rating based on historical data accuracy (e.g., “Farmers in this dataset have 95% consistency in logging”).

Blockchain-Powered Purchase & Delivery

You click “Buy Dataset.” Behind the scenes:

The smart contract verifies that you have sufficient cryptocurrency (e.g., stablecoins like USDC) in your linked wallet.

Payment is split automatically: 90% to the farmers, 10% to the platform as a fee.

The dataset is decrypted and downloaded to your dashboard instantly, accompanied by a blockchain certificate of ownership.

What Happens After You Buy

Re-Sell Insights? You could later sell your analysis (e.g., “Cocoa Yield Predictions 2027”) back to the platform, sharing royalties with the original farmers.

Subscribe: Set alerts for new cocoa datasets from Ghana.

Why Filters Matter — Precision, Transparency & Empowerment

Precision: Buyers avoid sifting through irrelevant data (e.g., a maize seed company isn’t flooded with coffee farm records).

Transparency: Every filter choice is recorded on the blockchain, preventing manipulation (e.g., a buyer can’t falsely claim data was “unfindable” to negotiate lower prices).

Farmer Empowerment: Filters prioritize high-quality, detailed data, rewarding farmers who invest time in accurate logging.

Explore the Future of Agricultural Data Trading — Interactive Mockup Demo

How the Interactive Marketplace Demo Works

To help you visualize the concept, below you’ll find a fully interactive mockup that demonstrates how this proposed agricultural data marketplace functions from two different perspectives—Buyer’s and Seller’s.

Browse Markets — The Buyer’s Perspective

First, explore the buyer’s view through the “Browse Markets” dashboard. This platform will allow agricultural companies, commodity traders, researchers, institutions, and other stakeholders to seamlessly browse and purchase anonymized farming data from across the globe.

From here, users can filter by crop type, region, and date range. Once narrowed down, they can easily preview and purchase individual spray events or seasonal data bundles using cryptocurrency.

Smart Filtering for Targeted Data Discovery

As this marketplace continues to mature, increasingly sophisticated and targeted filters will become available. These features are designed to help buyers find highly relevant datasets with precision. For instance, filters may include:

Climate-specific filters (arid regions, tropical zones, temperate climates)

Equipment-specific data (16-liter knapsack sprayers, drone applications, tractor-mounted systems)

Crop-specific insights (wheat pest management, corn fertilization, rice irrigation)

Farm size categories (smallholder farms, commercial operations, organic certified)

Seasonal timing (pre-planting, mid-season, harvest period)

Pest/disease specific outbreaks (locust swarms, fungal infections, drought stress)

Soil type classifications (clay, sandy, loamy soils)

By layering these filters, buyers can zero in on exactly the datasets they need.

Sell Your Data — The Farmer’s Perspective

Now, switching to the seller’s side of the interface, click “Sell Your Data” to experience a mobile-friendly platform designed specifically for farmers. This feature allows users to easily input their spraying records, pest observations, and field conditions.

Through this demo, you’ll be guided through a simple step-by-step data entry process, which concludes with an instant blockchain transaction and payment.

Real-World Marketplace Considerations

Although this demo shows instant transactions for simplicity, actual real-world deployment involves several additional factors that must be considered.

Blockchain Confirmation Times: In practice, blockchain transactions typically require between 2–15 minutes for confirmation, depending on network traffic and desired security settings.

Marketplace Dynamics: Unlike traditional storefronts, this ecosystem operates more like a data marketplace. That means:

Farmers upload and list their data with pricing

Buyers browse and evaluate available datasets

Purchase decisions hinge on relevance, quality, and pricing

Sales might occur instantly, but could also take days—or longer

Some data may remain unsold if market demand is low

No Guaranteed Revenue: It’s important for farmers to recognize that revenue from data monetization will depend on various factors. These include market demand, data quality, and competitive pricing. As such, income is not guaranteed and may be intermittent.

Ultimately, data monetization presents a promising opportunity—but not a certainty. It requires patience and persistence as the marketplace evolves over time.

Transparency, Empowerment, and Evolution

At its core, this mockup illustrates how technology can foster a secure, transparent marketplace—one that fairly compensates farmers for their invaluable agricultural insights.

At the same time, it equips prospective buyers with the data they need to improve profitability, drive innovation, and support sustainable farming practices across diverse regions.

Tip: Swipe left or right ⬅️➡️ to explore all table columns if you are viewing this article on your mobile phone.

Buy and sell verified, anonymized spray & sensor data from farms around the world.

Browse Markets Sell Your Data| Crop | Region | Last Sale | Volume | Farmers | Price/Event | Action |

|---|---|---|---|---|---|---|

| Corn | USA | 2024-09-10 | 1,200 | 25,000 | 0.02 USDC | |

| Potato | Germany | 2024-09-05 | 350 | 20,000 | 0.03 USDC | |

| Rice | Thailand | 2024-08-20 | 900 | 30,000 | 0.015 USDC | |

| Corn | Botswana | 2024-07-30 | 220 | 5,000 | 0.018 USDC | |

| Tea | Kenya | 2024-06-15 | 480 | 15,000 | 0.025 USDC | |

| Flower Bulbs | Netherlands | 2024-05-10 | 610 | 12,000 | 0.022 USDC |

Enabling Easy Crypto-to-Local Currency Payments

One of the most valuable aspects of this proposed blockchain-based marketplace would be its ability to provide farmers with instant earnings through cryptocurrency.

Yet, for many smallholder farmers in developing regions, direct access to crypto wallets connected to traditional banks remains limited.

To bridge this gap, the platform could introduce seamless solutions that convert cryptocurrency to local currency in real time — ensuring farmers can effortlessly access their funds.

Local Mobile Money Platforms — Simplifying Access

In this scenario, farmers receive cryptocurrency payments that are automatically converted into widely-used mobile payment services, such as M-Pesa in Kenya or MTN Mobile Money in West Africa. As a result, they can immediately withdraw cash from nearby kiosks or agents — all without needing a conventional bank account.

Leveraging Third-Party Conversion Services

Additionally, regional companies like Yellow Card, AZA Finance (formerly BitPesa), Paxful, and Binance P2P offer rapid crypto-to-cash conversion via user-friendly mobile apps. Farmers are notified via SMS and can cash out at local agents, removing technical barriers and enabling fast monetization of farm data.

Digital Wallets with Peer-to-Peer Capabilities

Alternatively, farmers can accept payments via services like Trust Wallet, Coinbase Wallet, or Binance Pay. These apps allow them to store crypto and convert it instantly into local currency through built-in peer-to-peer exchanges — a process that’s easy, secure, and doesn’t require bank involvement. Payments become usable at mobile money agents right away.

Ultimately, these payment solutions would guarantee that every farmer, regardless of their existing financial setup, can quickly and securely access earnings generated from their farm data — a major step toward financial inclusion.

Taxation and Regulatory Considerations

The conversion of cryptocurrency into local currency is generally subject to taxation, but the specific tax treatment varies significantly across regions. Farmers and platform developers must stay informed of local laws to ensure compliance.

Tax Reporting Simplified Through Automation

To assist farmers, the blockchain platform can offer automated transaction histories, earnings summaries, and downloadable tax documentation—tools designed to simplify tax reporting and compliance.

Tax Guidance for Key African Markets

Kenya: Excise Duty and Capital Gains

Earnings from crypto conversions may be taxed as income or capital gains. The previously applied 3% Digital Asset Tax was repealed in 2025 and replaced by a 10% excise duty on crypto platform service fees, while gains from selling crypto assets are subject to a 5% Capital Gains Tax.

Although M-Pesa does not yet directly interface with the Kenya Revenue Authority (KRA) for automatic crypto tax reporting, businesses accepting crypto payments must self-report to KRA.

Nigeria & Ghana: Formalization and Self-Reporting

In Nigeria, crypto taxation is becoming formalized, with income or capital gains tax applicable on profits, and a 7.5% VAT on crypto service fees. Ghana taxes crypto profits as capital gains at 15%, with income tax applying to mining or crypto salaries. In both countries, digital wallets provide clear transaction logs that assist tax reporting, but compliance currently relies on self-reporting by individuals and businesses.

South Africa: Intangible Assets and Reporting Thresholds

Cryptocurrency is treated as an intangible asset, not currency. Profits from crypto transactions are subject to Capital Gains Tax or Income Tax, depending on the nature of the transaction, with an annual capital gains exclusion of R40,000. Detailed reporting via annual tax returns is required.

Reporting Infrastructure and Platform Tools

It is important to note that automatic linkage between mobile money platforms and tax authorities for crypto tax compliance remains uncommon; users are still expected to self-report their earnings and transactions manually.

To help bridge this gap, major crypto platforms are increasingly introducing user-facing tools for generating tax-compliant reports, enabling individuals to organize, review, and submit relevant data more efficiently.

Staying Current: African Regulatory Evolution

As African regulatory and tax frameworks continue to evolve rapidly, it is essential to stay current with official guidance from local revenue services — and, where possible, to leverage built-in platform features that support seamless documentation and reporting.

Who Would Be Buying Farm Data in a Blockchain Marketplace?

We’ve described the digital “product” farmers could create from everyday farm activities, the kind of innovative marketplace where it might be traded, and the seamless payment methods that could, in turn, provide instant rewards.

However, raw data—like any commodity—only truly becomes a product the moment someone is willing to pay for it. So, who would potentially want to purchase highly granular agricultural data?

To begin exploring this, let’s consider the most obvious possibilities.

Agri-Chemical Companies Seeking Performance Insights

For instance, think of a multinational pesticide company meticulously analyzing detailed spray records from 10,000 farms. They would be particularly interested in understanding why their latest herbicide underperformed in regions with heavy rainfall, and they might use that insight to optimize future formulations.

In fact, to them, farmers’ spray records could represent far more than raw data—they might serve as a billion-dollar shortcut to product improvement, better targeting, and long-term competitive advantage.

Data-Driven Agrochemical Marketing Revolution: How to Monetize Farm Data with Blockchain

Before diving into the revolutionary impact of data on agrochemical marketing, it’s worth reflecting on where this all started. I began my journey in pesticide sales over 20 years ago—armed with product catalogs, printed brochures, and the hope that my company provided at least some basic prospective client lists.

I often wished I could see what products the farmer was already using, which pests were troubling them, and what competitor brands were sitting in their shed. That future has gradually arrived, powered by blockchain and real-time data collection, enabling farmers to monetize farm data with blockchain technology.

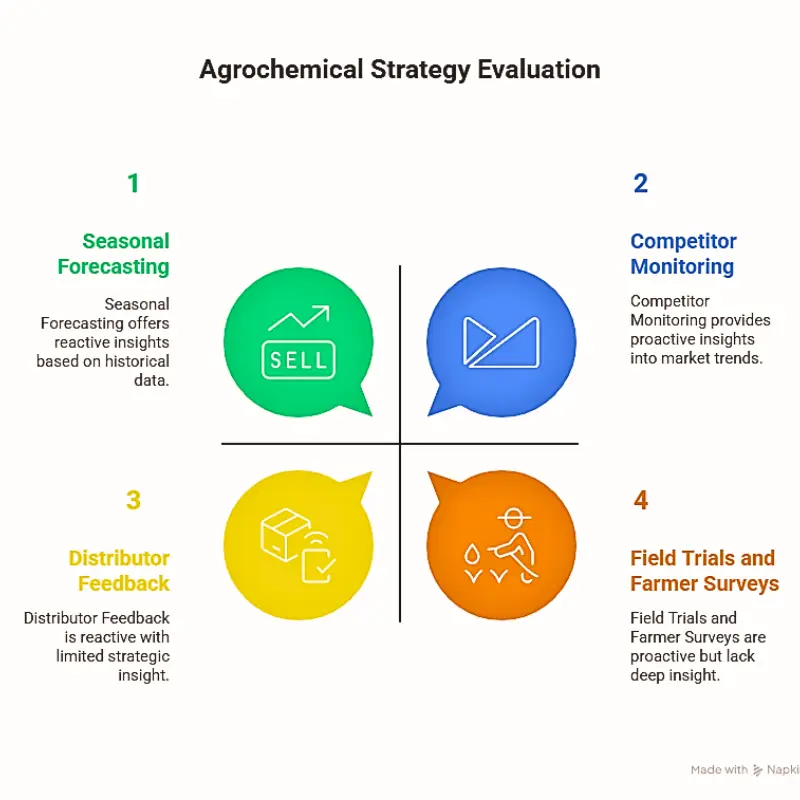

Traditional Agrochemical Strategies – Effective But Reactive

Agrochemical companies historically relied on:

-

Seasonal forecasting based on past sales and regional trends

-

Distributor feedback to guide inventory allocations

-

Field trials and anecdotal farmer surveys to shape messaging

-

Competitor monitoring via price sheets and informal intelligence

While functional, these strategies suffer from lag and inefficiencies, such as overstocking or shortages. For example, drought in Brazil can cause distributors to be stuck with excess glyphosate drums when soybean planting is delayed.

Enter Data-Driven Strategy – Real-Time, Hyperlocal, Predictive

Today, a new model is emerging—one that leverages raw farm-level data captured via OCR technology, blockchain, and machine learning. With apps enabling farmers to scan pesticide labels and upload usage data, marketing teams are now plugged directly into the field.

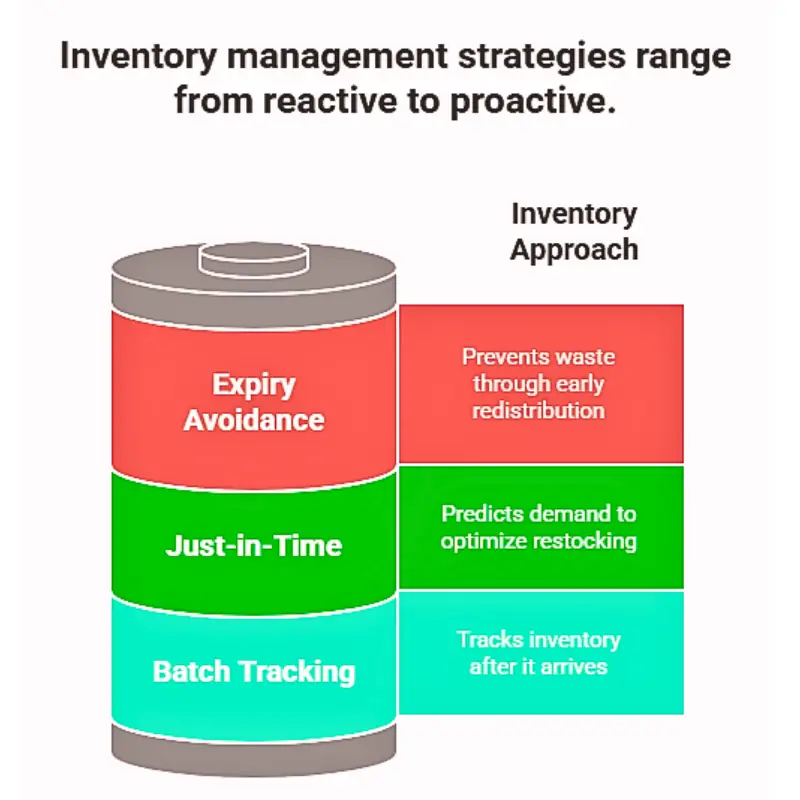

Precision Inventory Management

-

Batch Tracking: Combining batch numbers and container sizes optimizes supply chain logistics.

-

Just-in-Time Restocking: ML algorithms identify rising demand zones and adjust deliveries.

-

Expiry Avoidance: Overstocked SKUs are flagged early for redistribution or discounting.

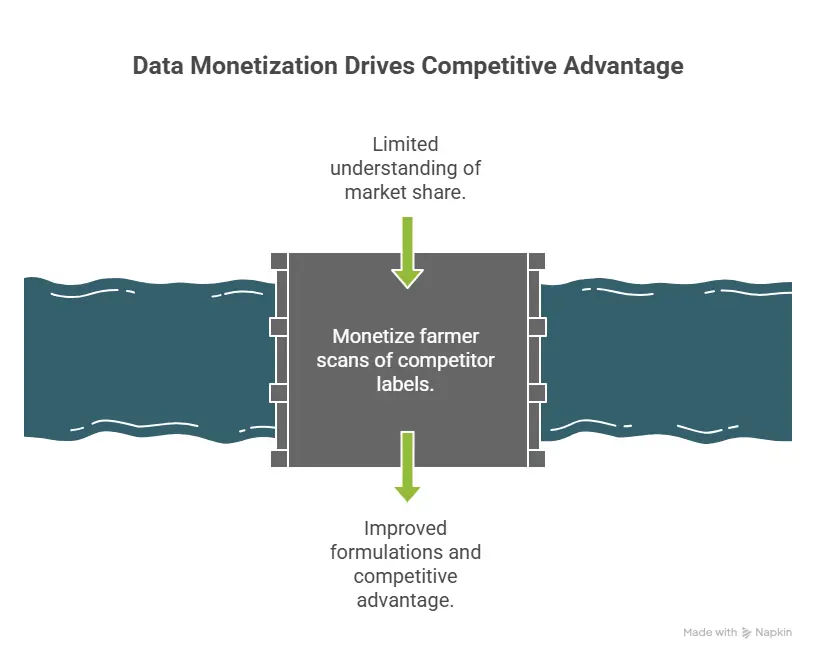

Competitor Intelligence, Finally Quantified Through Data Monetization

-

Farmer scans of competitor labels reveal which brands are gaining market share.

-

Real-world usage patterns help refine formulations, such as adjusting herbicide rates in waterlogged zones.

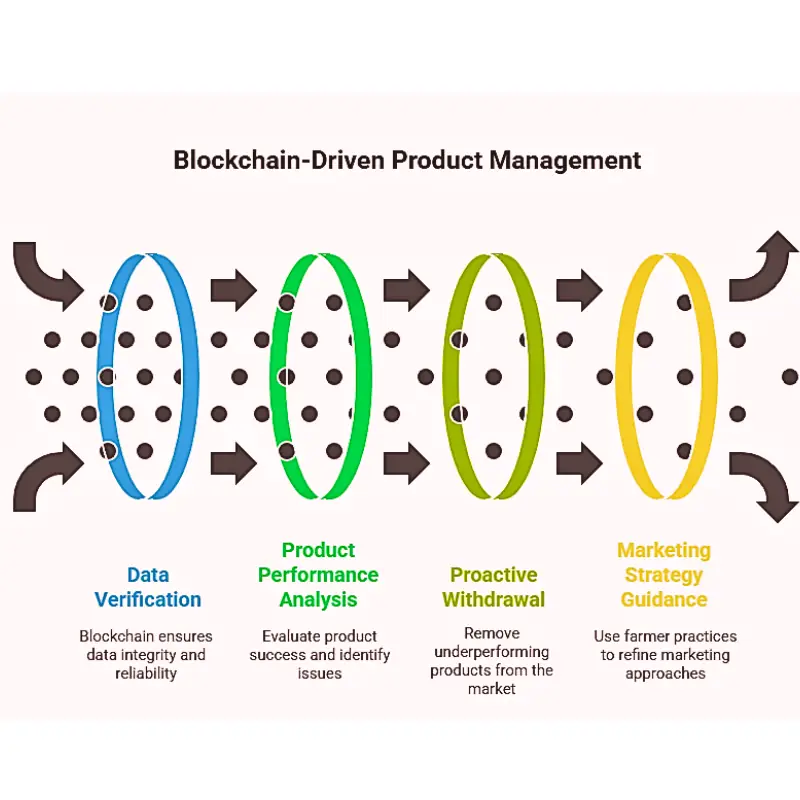

Product Performance in the Wild: Blockchain-Powered Insights

-

Early efficacy reports inform R&D on new product launches.

-

Poorly performing products can be proactively withdrawn based on blockchain-verified data.

-

Emerging farmer practices, like tank mix trends, guide marketing strategies.

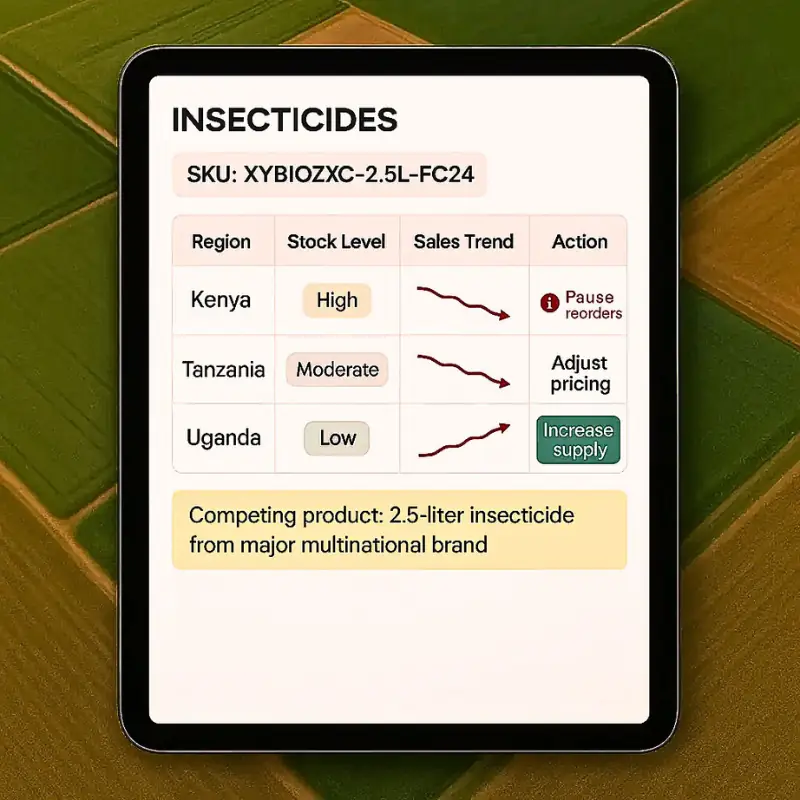

SKU-Level Intelligence for Enhanced Product Tracking and Monetization

SKU (Stock Keeping Unit) data facilitates:

-

Market-level decisions on pack sizes and preferences (e.g., Uganda vs. Tanzania).

-

Counterfeit detection and precision product recalls through blockchain traceability.

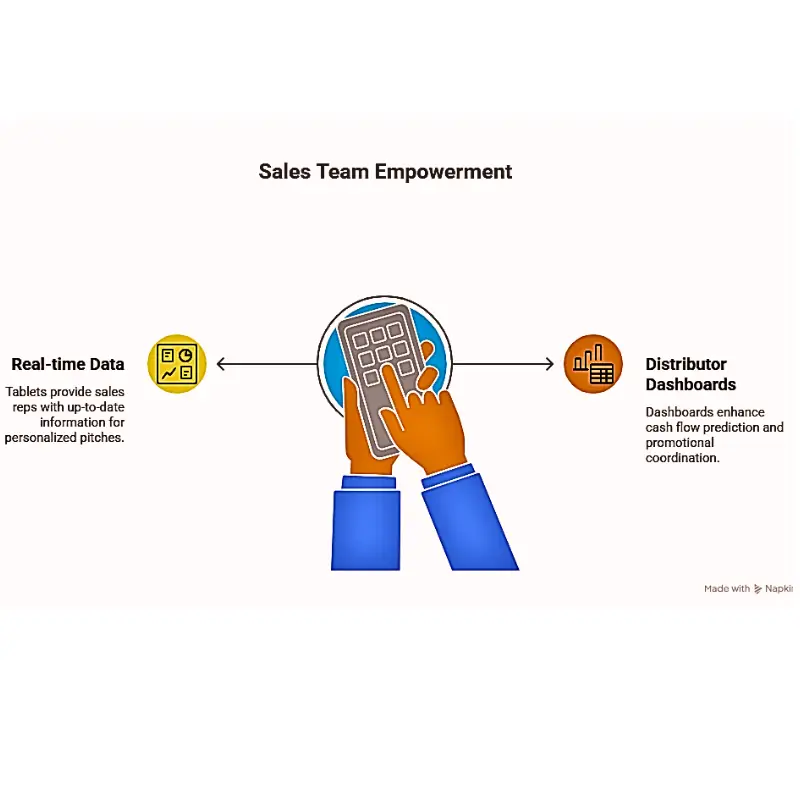

Empowering Sales Teams with Blockchain-Enabled Field Data

-

Tablets synced with real-time data enable sales reps to tailor pitches: “Farmer X uses Competitor Y but struggles with pest Z.”

-

Distributor dashboards improve cash flow forecasting and promotional alignment.

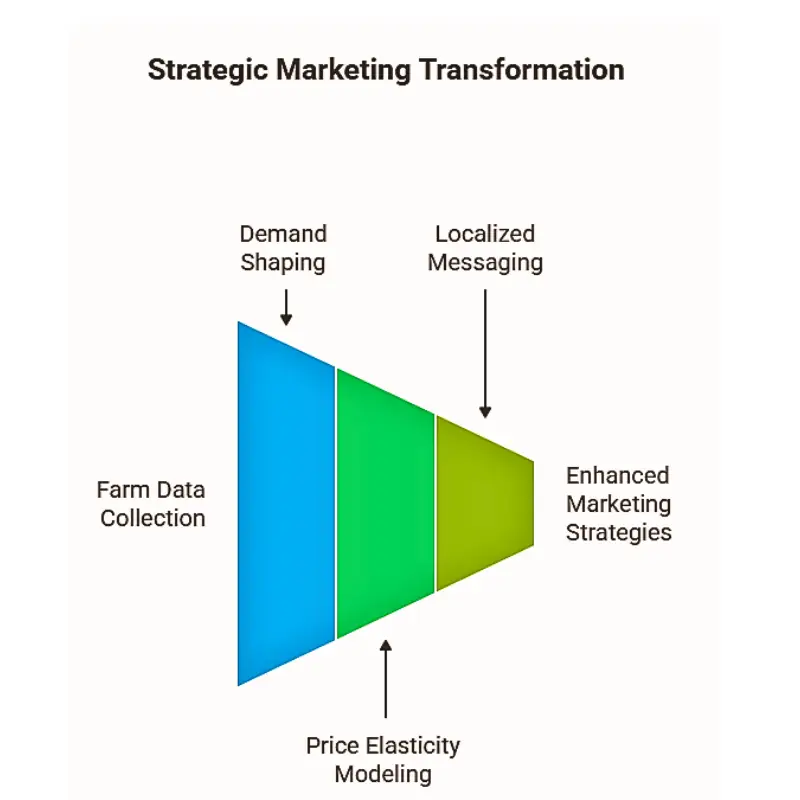

Strategic Marketing Transformation Through Monetized Farm Data

Demand shaping via loyalty programs and seasonal discounts.

Price elasticity modeling using inventory and market pricing data.

Localized messaging highlighting appropriate agrochemical offers in regions with low adoption or resistance indicators, based on real-time sensor and usage data.

How Urban Gardeners Can Monetize Their Growing Data

The distinction between commercial farmers and urban gardeners is rapidly disappearing, especially when it comes to data monetization opportunities described in this scenario.

Whether you’re managing a backyard vegetable plot, rooftop garden, or commercial farm, your cultivation practices and chemical usage patterns could represent valuable data that companies may be willing to purchase. Learn more about optimizing chemical and organic inputs here.

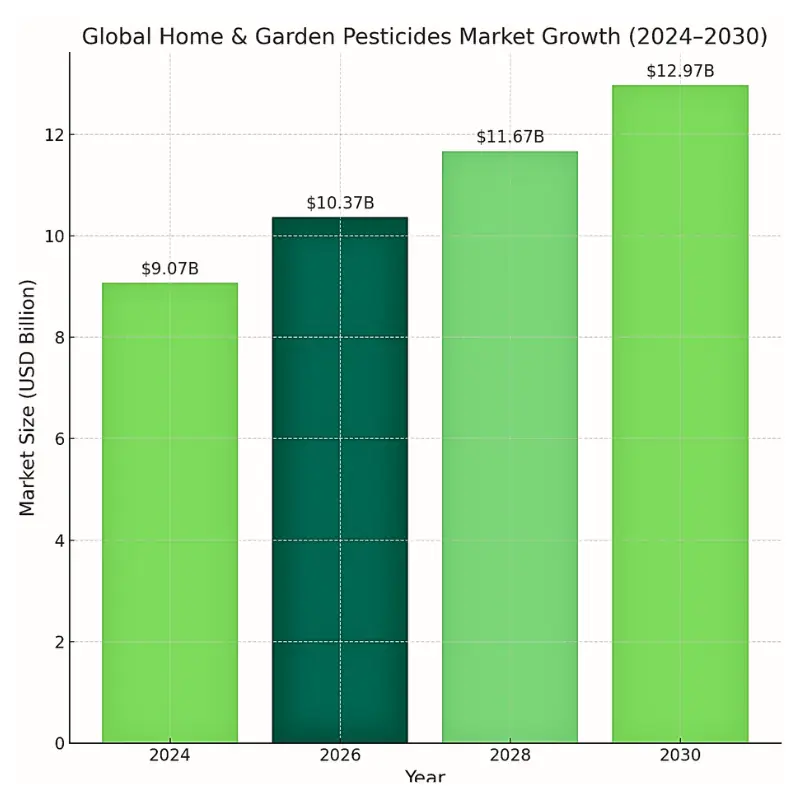

The home and garden pesticides market, valued at $8.58 billion in 2023, is projected to reach $12.97 billion by 2030 with a 6.2% CAGR. (source Grand View Research)

This expanding market creates significant opportunities for hobby and urban gardeners to monetize their data on herbicides, insecticides, fungicides, and organic treatments, especially if you use smart gardening gadgets and layout strategies that simplify record keeping.

The Takeaway – From Reaction to Precision in Monetizing Farm Data with Blockchain

This transformation is more than a tool upgrade—it’s a fundamental mindset shift. Agrochemical companies can:

-

Slash waste by a significant annual percentage.

-

Predict demand probably 6–8 weeks earlier than traditional methods dependent on past season data.

-

Launch new products with surgical precision.

Farmers benefit by moving beyond simply purchasing inputs to actively shaping product development and marketing.

By leveraging OCR scans, blockchain logs, and SKU metadata, agriculture steps confidently into an era of robust farm data monetization and real-time marketing agility.

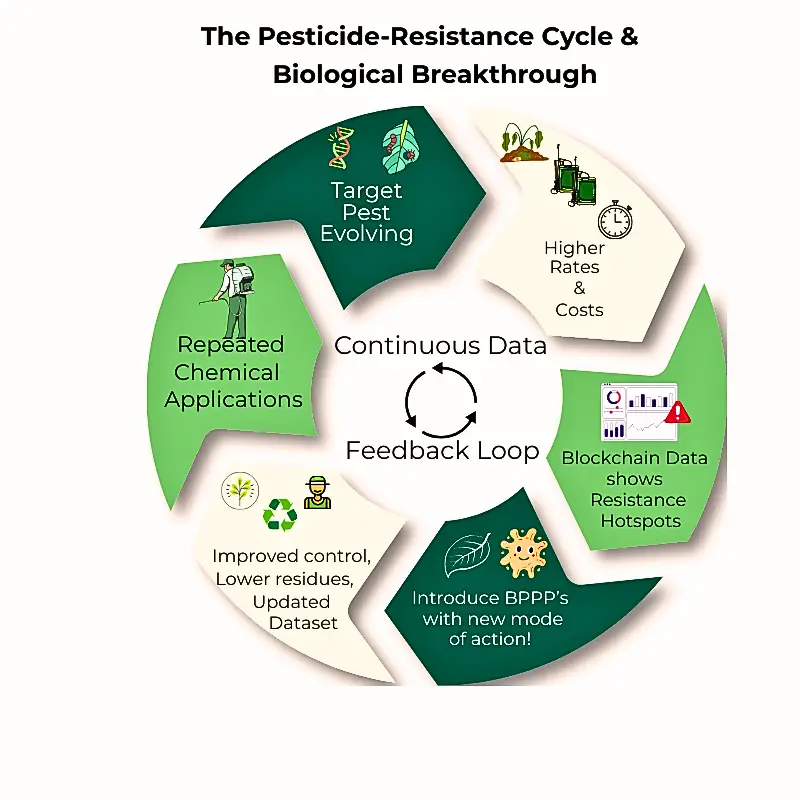

Biologicals: Hidden Farm Data Monetization Opportunity

Manufacturers of Biological Plant Protection Products (BPPPs) represent a unique and significant buyer segment within the blockchain-based agrodata marketplace.

Unlike traditional chemical pesticides, the performance of biological products is intricately dependent on precise environmental and application data. Therefore, this makes detailed agrodata not just valuable, but essential for their success.

Could BPPP Manufacturers Benefit from Your Data?

Firstly, biological solutions such as biopesticides, biofungicides, and beneficial microorganisms are highly sensitive to variations in environmental conditions. For example, factors such as humidity, soil pH, temperature fluctuations, and application methods significantly impact their efficacy.

Unlike traditional, one-size-fits-all chemical approaches, biological solutions require much more granular, farm-level data. Consequently, the need for accurate, localized data becomes evident.

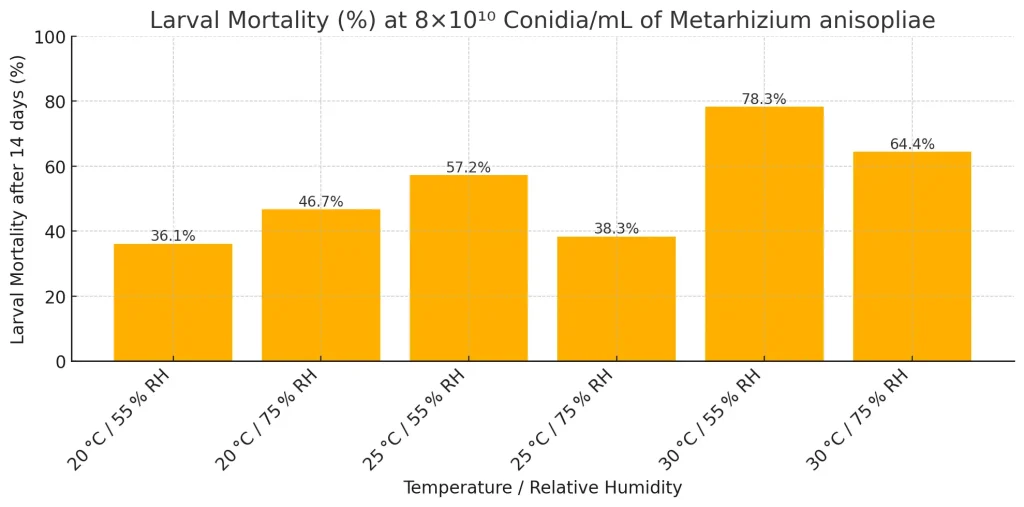

The Impact of Environmental Factors on Biological Efficacy

To illustrate the variability shown in the chart above, even at the highest tested dose, Metarhizium anisopliae control ranged from 36% to 78%, depending solely on temperature and relative humidity.

This dramatic spread—visible in the experimental data—highlights how sensitive biological efficacy is to environmental conditions.

If such variation occurs under tightly controlled lab settings, imagine the fluctuations a grower faces in the field. This underscores a compelling opportunity: with hyper-local weather and soil data flowing through a blockchain marketplace, formulations can be fine-tuned for real-world precision.

Why Maximum Strength Does Not Guarantee Maximum Control

Critically, maximum strength does not guarantee maximum control; rather, the environment plays a decisive role. This single insight explains why BPPP R&D teams prioritize climate-tagged datasets.

As demonstrated in Table 5 of the Journal of Insect Science study, peak efficacy occurs around 30°C and 55% relative humidity (RH) – with control rates doubling compared to cooler, drier conditions.

These findings confirm microclimate data’s indispensable value for product positioning, label expansion, and ongoing support. (See experimental validation: PMC5388312, Table 5)

Using Agrodata Trade Platforms to Optimize Biological Products

Moreover, exploring the agrodata trade platform’s specific climate or resistance-hotspot filters will enable manufacturers to identify similar gaps.

This, in turn, helps tailor formulations and launch data-driven field trials where biologicals can outshine conventional chemistries. Ultimately, farmers who monetize farm data with blockchain thus unlock a hidden revenue stream by selling essential agrodata to BPPP producers.

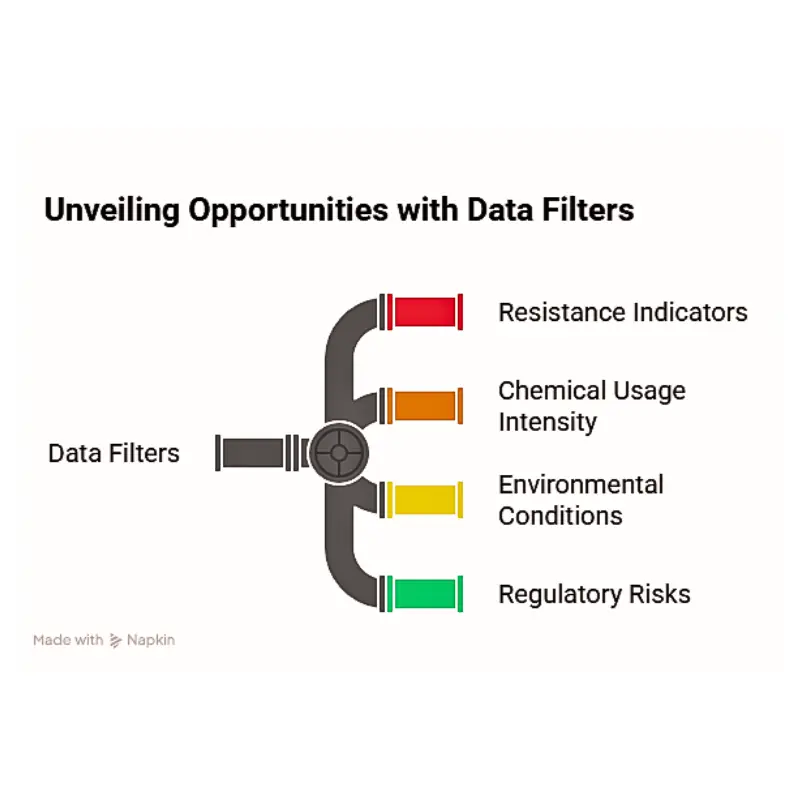

Essential Data Filters for BPPP Companies on the Platform

To efficiently identify opportunities, BPPP manufacturers would benefit from specific filters:

Resistance Indicators: Filter data highlighting pest resurgence, increased spray frequency, or yield reductions despite chemical use.

Chemical Usage Intensity: Highlight farms that frequently apply pesticides or use high dosages, indicating opportunities for biological alternatives.

Environmental Conditions: Identify scenarios such as heavy rainfall or high humidity, where biological products outperform chemical counterparts.

Regulatory Risks: Focus on regions that restrict or ban certain chemical pesticides, offering clear pathways for biological solutions

Real-World Case for Data-Driven Biological Solutions

A practical scenario would involve tomato growers in Spain dealing with Tuta absoluta resistance to traditional chemical controls, such as spinosad.

A biological company analyzing platform data identifies this challenge, launches a targeted marketing campaign highlighting cost reductions and efficacy improvements of their Beauveria bassiana-based biopesticide, and successfully establishes trials validated by blockchain data.

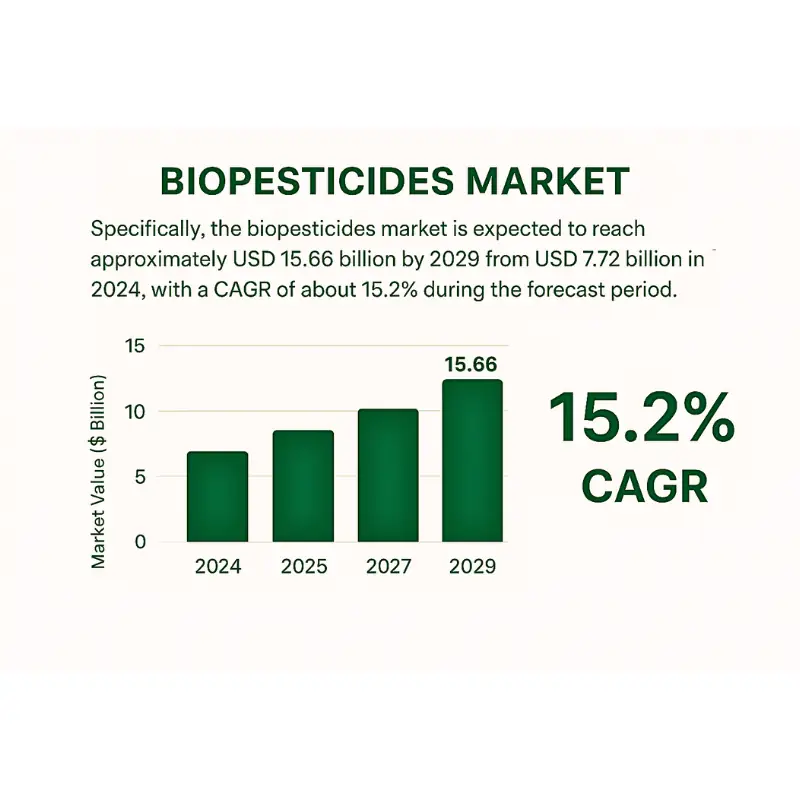

Unlocking Growth with Biological Solutions

The information about the global biopesticide market projected to grow at a compound annual growth rate (CAGR) around 14.7% to 15.2% from 2023 to 2030, as aligned with the capabilities offered by detailed agrodata on blockchain platforms, can be found in reports from MarketsandMarkets.

By leveraging farm-level data for precision targeting, product optimization, and regulatory alignment, BPPP manufacturers can significantly displace traditional chemical pesticides, driving sustainable agriculture and providing farmers with more effective, eco-friendly solutions.

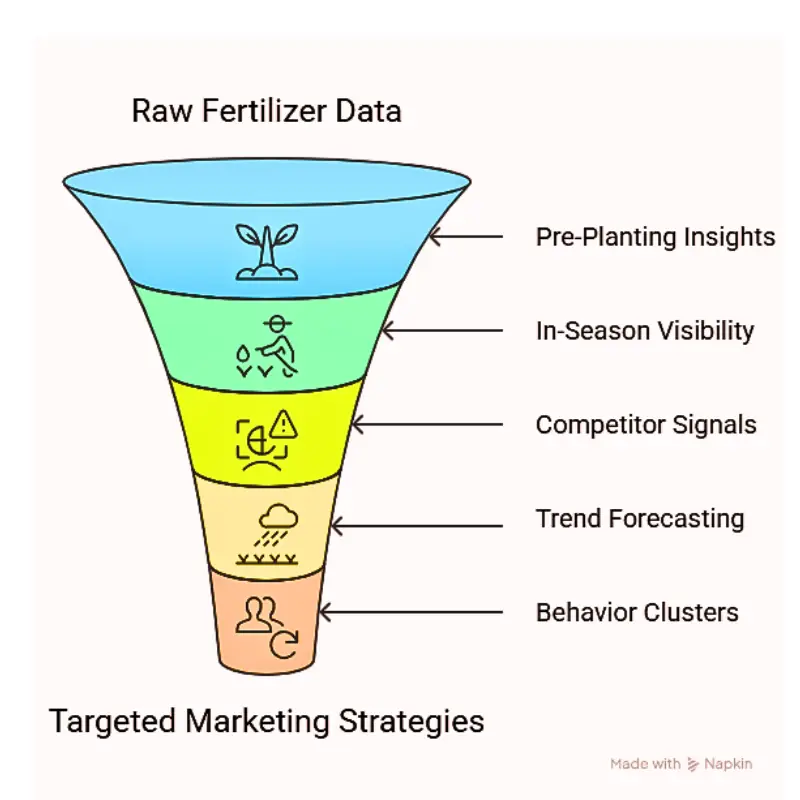

Fertilizer Intelligence: Monetize Application Data

.

Imagine knowing exactly which fields received a foliar spray at 8 AM last Tuesday, how much nitrogen was absorbed per hectare, and which competitor’s product the farmer switched to after rain disrupted granular applications. Which playbook would you rather run?

Why Hyper-Detailed Fertilizer Data Matters

Moreover, a modern fertilizer marketing specialist now opens a dashboard that reveals:

-

Pre-Planting Precision – Historical soil tests, combined with residue maps, signal exact potassium (K) shortages, prompting early-season promotions for potash-rich blends.

-

In-Season Visibility – Time-stamped logs show where urea is over-applied in waterlogged zones; messaging pivots to slow-release, stabilized nitrogen.

-

Competitor Signals – OCR scans flag sudden spikes in calcium nitrate use along Kenya’s coast—evidence of a rival’s discount blitz.

-

Furthermore, Trend Forecasting – Weather-linked datasets predict drought-driven shifts from granular to liquid fertilizers weeks ahead.

-

Behaviour Clusters – Data segments “tech-savvy split-applicators” versus “price-first broadcasters,” enabling laser-focused loyalty programs.

From Bulk Forecasts to Precision Plays

Therefore, traditional fertilizer playbooks reorder based on last year’s tonnage. However, a demand-forecast engine would spot potash spikes in low-K fields three weeks early.

Marketing often pushes a one-size-fits-all 5-15-15 promo. Micro-segmented bundles, in contrast, would be matched to soil cation exchange capacity (CEC), pH, and historical yield maps.

In this scenario, competitive positioning via dealer gossip changes to near-real-time label-scan dashboards ranking each polymer-coated urea’s territory share. As a result, reactive “prepay” discounts and dynamic pricing auto-triggers would activate when platform traffic signals stocking urgency.

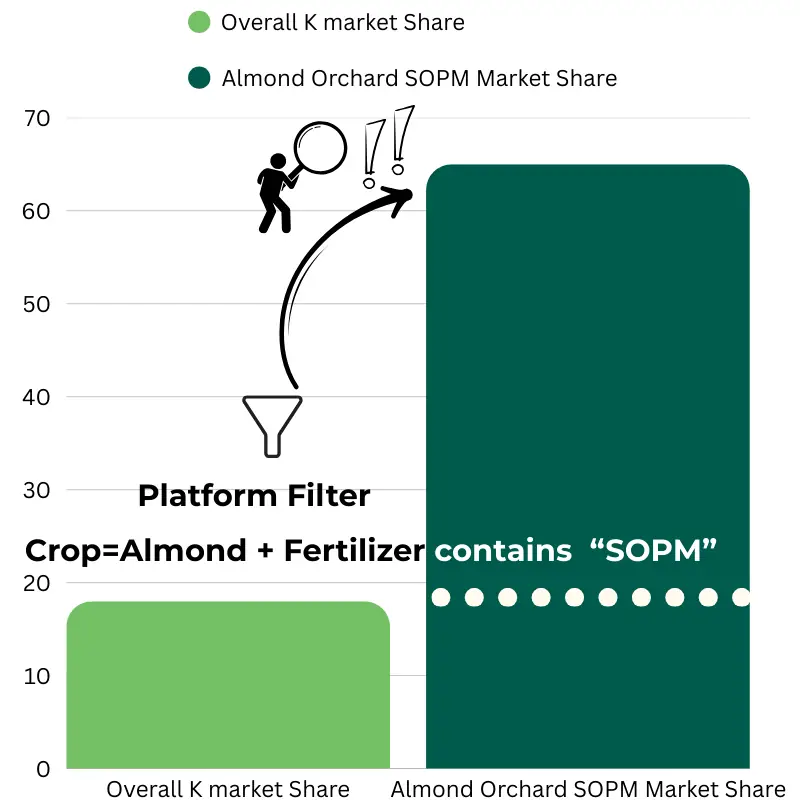

Case in Point: Unveiling Niche Competitor Strength in Almond Orchard Applications

For example, the old approach relied on distributor feedback and broad market surveys, estimating Competitor “ABC” Solutions holds about 15% market share for potassium fertilizers overall in a mixed farming region such as California’s Central Valley.

The new data insight—bought from farm data analytics—shows “ABC” Solutions’ overall K share from farmer scans is around 18%. However, filtering by crop type (almonds) and fertilizer name (containing “Sulfate of Potash Magnesia” or SOPM/K-Mag) reveals that ABC Solutions actually holds a 65% market share specifically for this premium K product in high-value almond orchards.

For instance, their standard Muriate of Potash (MOP) share is negligible outside row crops. Farmer notes linked to these scans frequently mention “better nut fill” or “addressing magnesium deficiency.”

To illustrate, the traditional view missed this competitor’s dominance in a high-margin niche. Market share looks flat until zooming in on orchard rows, where one brand quietly owns two-thirds of the premium K segment.

Platform filters (Crop = Almonds + Fertilizer contains “SOPM”) revealed ABC Solutions’ hidden 65% stronghold, missed by broad surveys pegging them only at 18% overall K share.

This new data allows companies to understand that competing requires a specific SOPM product targeted at almond growers concerned with both potassium and magnesium, not just a general potassium strategy.

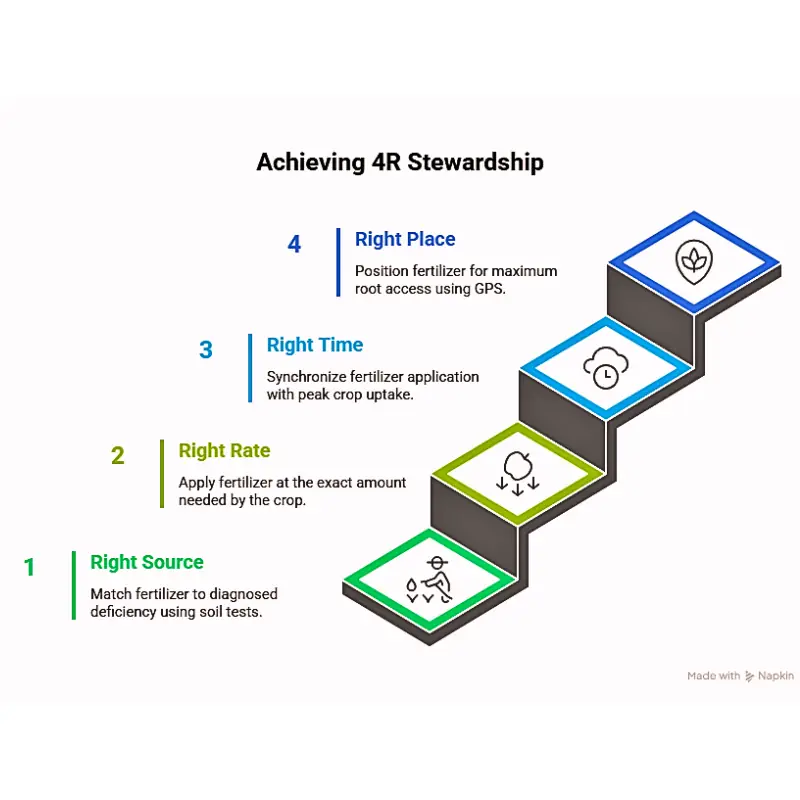

Looking Ahead: Implementing 4R Stewardship in Fertilizer Management

Looking Ahead: Implementing 4R Stewardship in Fertilizer Management

Indeed, the 4R principles—Right Source, Right Rate, Right Time, and Right Place—are enabled by agrodata:

Right Source: Match product to diagnosed deficiency. Label scans and soil tests confirm zinc-fortified blends only where tissue tests show low zinc.

Right Rate: Apply no more, no less than crop needs. Undoubtedly, side-dress logs versus yield outcomes flag over- or under-application in real time.

Right Time: Synchronize supply with peak uptake and minimize loss risk. Certainly, timestamped applications cross-checked with rainfall forecasts prevent nitrogen losses before storms.

Right Place: Position nutrients for maximum root access. GPS-tagged banding versus broadcast layers verify nutrients are placed where roots can reach them.

Importantly, by aligning with 4R principles—and documenting this process on an immutable blockchain ledger—fertilizer firms can reduce waste, meet regulatory requirements, and establish a sustainability narrative that resonates from the boardroom to the farm.

This strategic approach empowers farmers to monetize farm data with blockchain technology, unlocking new value streams and driving smarter fertilizer management decision-making.

Monetize Farm Data: Seed Performance Predictions

The revolution in farm data monetization extends profoundly into the world of seed genetics and marketing. For instance, imagine a global seed company’s market strategy team, which traditionally built careers by analyzing performance data from meticulously managed research plots and consolidating regional sales projections.

For years, success meant launching hybrids that performed well on average across vast territories, relying heavily on controlled trials supplemented by surveys and feedback from key dealers.

However, understanding the genetic potential in ideal conditions was standard; predicting how a specific hybrid would truly perform under the unique stresses of a particular farmer’s field — specific soil type, microclimate, and weed pressure — remained the elusive “last mile” of insight.

As a result, granular data isn’t just a tool anymore; for modern seed strategists, in fact, it is becoming the ultimate competitive rootstock.

Traditional Seed Marketing & Planning – Potential Measured, Reality Inferred

Seed companies have traditionally based their strategies on several key sources:

Controlled Performance Trials: Evaluating hybrids in limited, managed environments, often not fully reflecting real-world farm variability.

Distributor Sales Data: Tracking which hybrids are ordered in bulk by region, indicating broad preferences but not granular performance.

Farmer Surveys & Dealer Feedback: Gathering subjective opinions on performance, often aggregated and potentially lagging behind emerging issues.

Public Acreage & Yield Reports: Using government data for high-level market sizing and trend analysis.

Competitor Catalog Analysis: Understanding competitors’ listed traits and general positioning based on their marketing materials.

While essential, this approach often meant launching products based on broad adaptability — for example, “This maize hybrid works well in East Africa!”

However, this method sometimes misses opportunities for niche dominance or fails to anticipate localized performance issues until substantial farmer feedback or complaints surface.

Thus, predicting the true yield variability or stress tolerance across thousands of unique farm environments was more art than science.

Data-Driven Seed Strategy – Decoding Real-World Genetic Expression

Thanks to future availability of farmer-generated, field-specific data via advanced platforms, the entire equation would fundamentally change. For seed strategists, this granular insight allows an unprecedented understanding of genetics’ real-world performance.

Real-World Performance Validation & Trait Efficacy

Beyond average yields, accessing yield data linked to specific hybrids, GPS coordinates (soil type, topography), weather data, and crop health observations would enable companies to map actual performance across diverse real-world conditions.

This, therefore, helps identify pockets of over- or underperformance that are typically missed by regional averages.

Moreover, tracking trait performance under stress becomes possible by correlating data on specific pest infestations, disease outbreaks, or environmental stresses (weather data, soil conditions) with the hybrid’s known genetic traits.

For example, data might show that in parts of India, 72% of farmers planting specific pest-resistant cotton hybrids avoided an average of three or more pesticide sprays per season compared to neighbors using non-traited varieties.

In addition, environmental stress tolerance can be quantified by linking weather data (droughts, heat waves, excessive moisture) and soil tests (low pH, salinity) to hybrid performance and vigor (NDVI data, farmer notes).

Perhaps data demonstrates that a specific hybrid maintains 85% yield potential in environments receiving less than 500mm rainfall, compared to only 55% for standard varieties under the same stress conditions.

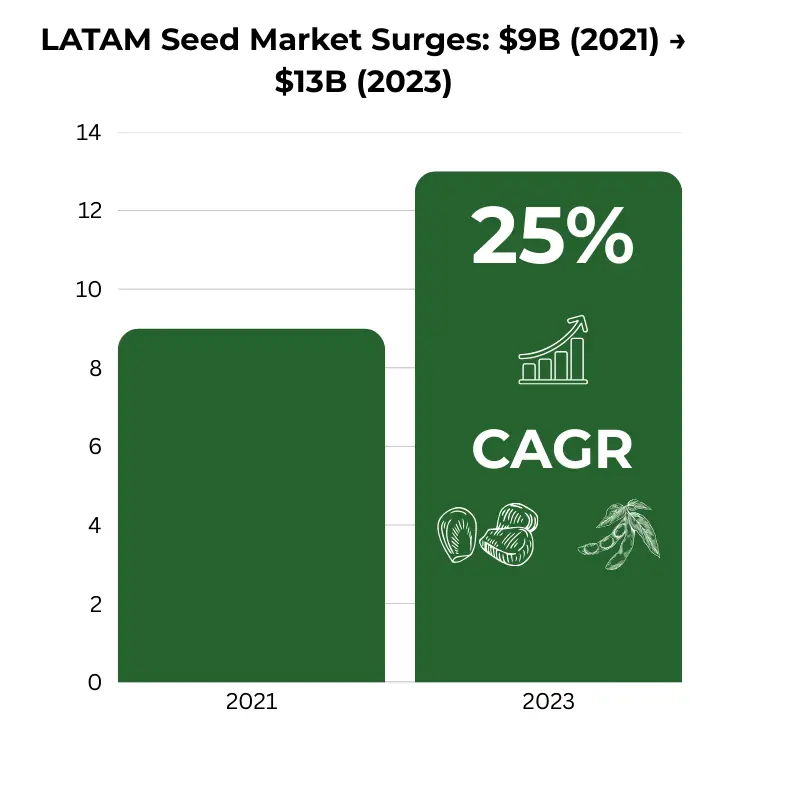

Hyper-Localized Adaptation & Planting Recommendations

Recent market research highlights dynamic shifts within seed marketing landscapes. For instance, Latin America’s corn and soybean seed markets surged from approximately $9 billion in 2021 to $13 billion in 2023, accounting for nearly half of the global seed market expansion during that period (Kynetec).

This sharp regional growth underscores increasing complexity and competitiveness, emphasizing why relying solely on traditional broad-based marketing strategies risks missing hyperlocal opportunities.

Matching Hybrid to Micro-Environment: Identifying specific soil types or microclimates where a particular hybrid excels or struggles enables highly targeted recommendations. Consequently, this allows a transition from broad marketing statements to precise advice — such as promoting salt-tolerant rice seeds only on coastal Bangladeshi farms, where data confirms soil salinity exceeds 4 dS/m.

Climate Adaptation Insights: Correlating seed performance with detailed climate data allows for proactive market positioning.

Optimizing Planting Practices & Pricing: Analyzing data on planting dates, soil temperature, emergence, and population density helps refine recommendations. This insight supports dynamic pricing strategies, potentially offering timely discounts on drought-resistant varieties entering arid periods.

Predictive Market Intelligence & Competitor Benchmarking

Furthermore, seeing actual competitor performance moves beyond catalog comparisons, revealing which competitor hybrids are planted nearby, under what conditions, and how their yield and health compare locally.

Additionally, identifying unmet needs and emerging trends helps spot regions where all current hybrids struggle with specific stresses, signaling market opportunities. This also aids in predictive demand modeling, such as stockpiling beetle-resistant bean seeds ahead of peak seasons in particular locations.

Understanding Farmer Behavior & Influences

Analyzing switching behavior using historical and current data alongside farmer insights explains why farmers move between hybrids — whether due to yield, price, or trait performance.

For example, data might reveal that 68% of smallholders in a Mexican region prioritize drought resilience in maize over maximum yield potential, shifting marketing messages correspondingly.

Moreover, validating marketing claims by comparing farmer-reported performance with company promises on yield potential, drought tolerance, or disease resistance strengthens trust and transparency.

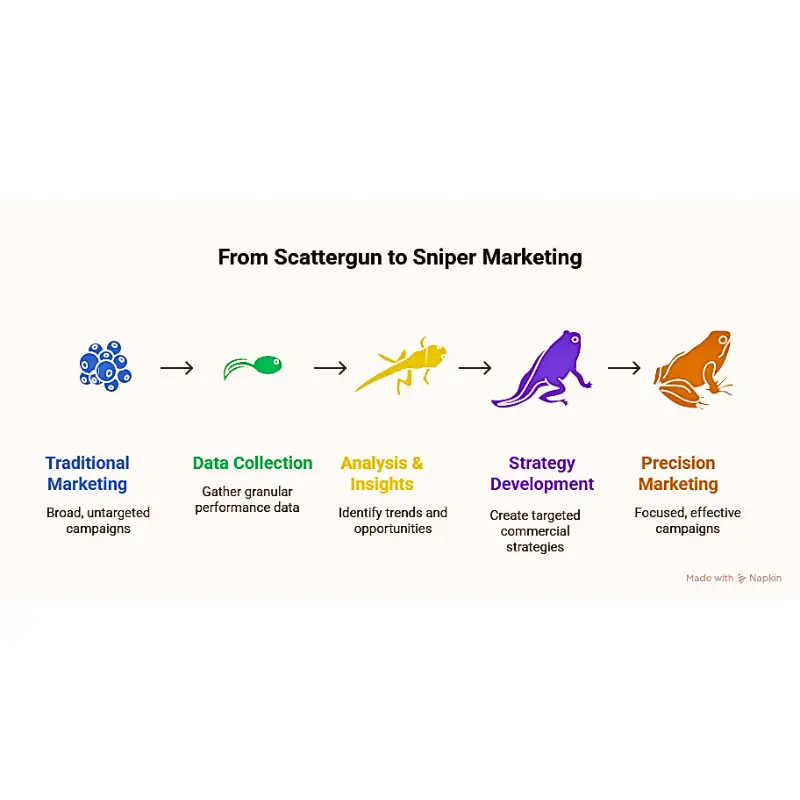

Fine-Tuning Seed Marketing and Sales with Granular Data

This newfound intelligence will directly translate into sharper, more effective commercial strategies, transforming traditional scattergun approaches into sniper-like precision:

Precision Marketing Campaigns: Target promotional efforts for specific hybrids toward geographic areas and farm types where data shows the highest performance advantage or fills critical unmet needs.

Empowered Sales Agronomists: Equipping field teams with localized performance data and competitor comparisons (e.g., “In fields like yours within an 80-kilometer radius, our Hybrid Z out-yielded Competitor Y by 0.5 tones per hectare under similar rainfall last season”) adds immense credibility.

Data-Driven Seed Guides & Case Studies: Developing highly regionalized guides backed by specific examples builds trust. For instance, data showing that 40% of Mato Grosso soybean farmers struggle with root-knot nematodes enabled launching a campaign for nematode-resistant seed with targeted ads, incentives, and messaging (“87% yield retention in nematode-infested fields”), resulting in a 34% market share gain within one season.

Strategic Discounting, Bundling & Counterplay: Offering targeted introductory pricing or bundling seed with related inputs where data shows combined effects enhances value. For example, bundling free soil moisture sensors with seeds in regions where competitors aggressively undercut prices adds tangible benefits beyond seed cost.

Accelerated Feedback Loop: Broad real-world data shortens time to identify winning hybrids for scaling and underperformers for phase-out.

The Genetic Edge – From Broad Potential to Proven Local Performance

.

For seed companies, leveraging farmer-generated data would represent a paradigm shift — moving from selling genetic potential based on controlled trials to demonstrating proven genetic performance tailored to individual farm realities.

The ability to precisely map, predict, and validate hybrid performance across countless real-world scenarios unlocks significant competitive advantages:

Faster placement of the right genetics onto the right acres.

Reduced risk associated with new hybrid launches.

Increased farmer loyalty through data-backed, tailored recommendations.

More efficient R & D informed by rapid, diverse, real-world feedback.

Looking ahead, this data will enable AI-powered recommendation engines that suggest optimal seeds based on real-time conditions, verify sustainability credentials (like reduced water or nutrient needs), and foster farmer loyalty loops rewarding ongoing data sharing.

Ultimately, it will transform seed marketing and sales from scattergun blasts based on averages to sniper-like precision guided by real-world data.

The Future of Farm Data Monetization Through Blockchain

A blockchain-powered data marketplace could revolutionize how farmers monetize farm data with blockchain technology. If developed, such a platform would enable farmers to securely trade verified field data while seed companies could access authenticated insights for product development.

This proposed ecosystem would create new revenue streams for farmers and provide seed companies with granular data to enhance breeding programs and market strategies.

How Farmers Can Monetize Farm Data: Precision Agriculture Integration

Precision agriculture platforms currently stand at the confluence of satellite imagery, IoT sensors, weather data, and complex agronomic models. Furthermore, for companies developing these sophisticated digital farming solutions, the ultimate goal is to provide farmers with timely, accurate, and actionable insights to optimize every aspect of their operation.

Your satellites see the field, your sensors feel the soil, your algorithms predict the future – but do you honestly know what the farmer did next, and why? Consequently, for precision agriculture platforms, bridging the gap between digital models and ground-level reality represents the final frontier, which could be unlocked by enabling farmers to monetize farm data with blockchain technology.

The Role of R&D in Precision Ag Platforms

Imagine the R&D lead at a cutting-edge digital agriculture firm, constantly refining algorithms that predict disease outbreaks or generate variable-rate seeding maps. Their platform might ingest terabytes of remote sensing and weather data daily.

Nevertheless, the persistent challenge remains: how accurately does the digital model reflect the complex, often unpredictable reality unfolding hectare by hectare (acre by acre) on the ground?

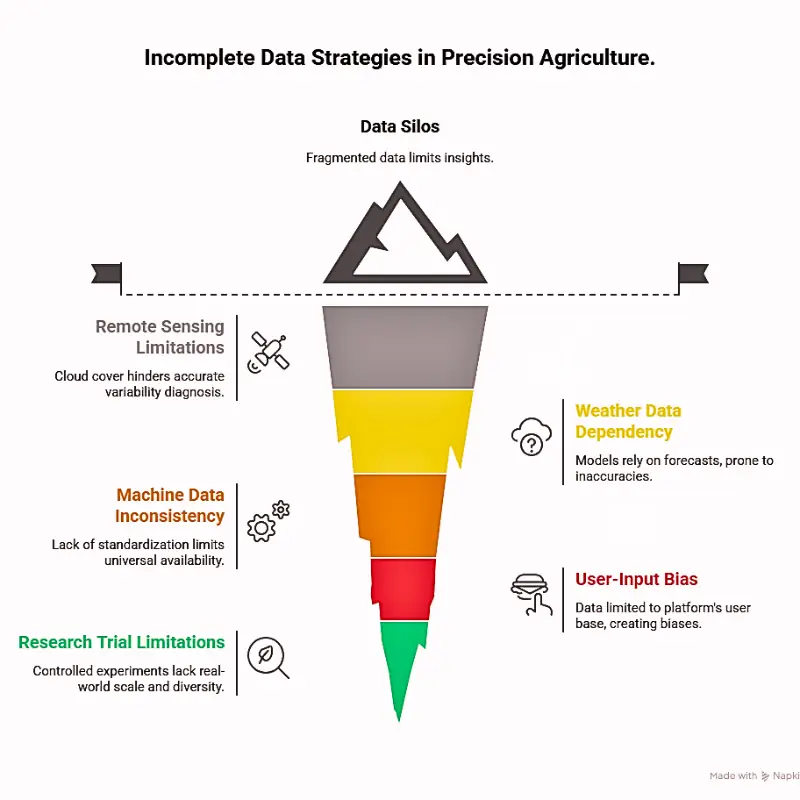

Current Precision Ag Data Strategies – Powerful but Incomplete

Providers of digital farming solutions currently rely on a mix of data sources, including:

Remote Sensing: Satellite, drone, and aerial imagery provide invaluable field-scale views of crop variability (e.g., NDVI). However, this method can be hindered by cloud cover and may not always accurately diagnose the cause of variability.

Weather Data: Forecasts and historical data drive predictive models for growth stages, disease risk, and other factors.

Machine Data: Information from tractors and implements (telematics) shows what was applied where, if equipped and connected. Unfortunately, this data isn’t universally available or standardized.

User-Input Data: Farmers manually enter data into the platform (field boundaries, planting dates, scouting observations within that specific platform), yet it is often limited to the platform’s user base, which can create potential biases and gaps.

Internal Research & Trials: Controlled experiments provide baseline data but lack real-world scale and diversity.

While powerful, this approach has clear limitations. Critically, validating algorithms across millions of diverse, real-world scenarios with independent ground-truth data remains a significant hurdle.

The Blockchain Data Marketplace Advantage – Bridging the Digital-Physical Divide

Accessing a diverse and high-volume stream of granular, farmer-generated data from a blockchain marketplace offers transformative benefits for precision agriculture companies. These benefits are many and can be categorized as follows:

Supercharging Algorithm Development & Validation

Firstly, when farmers monetize farm data with blockchain technology, precision agriculture companies could benefit through:

Massive Training Datasets: By feeding AI/ML models vast amounts of real-world, labeled data (e.g., farmer photos of specific weeds or diseases tagged with GPS and crop stage), companies can drastically improve image recognition accuracy for scouting tools.

Ground-Truthing Predictive Models: They can validate disease risk forecasts by comparing predictions against actual, time-stamped farmer observations of disease presence or absence across thousands of fields and microclimates. For instance, did the algorithm predict high Fusarium risk, and did farmers in that zone report it and apply specific fungicides?

Refining Variable Rate Algorithms: Correlating platform-generated variable rate application maps (seed, fertilizer, pesticides) with farmer-logged observations of crop vigor, localized pest pressures, and, crucially, sub-field yield variations (if available) fine-tunes zoning and rate calculations.

Benchmarking Performance: Companies can analyze how specific input choices (seed variety, fertilizer type, pesticide application) recorded on the platform correlate with observed outcomes under different environmental conditions, providing real-world calibration data for recommendation engines.

Unlocking Real-World Farming Intelligence

Moreover, as farmers monetize farm data with blockchain platforms, precision agriculture companies could gain unprecedented insights into:

Identifying Adoption Gaps: Specifically, they could see which recommended practices (from the digital platform or general agronomy) are being adopted versus ignored, and potentially uncover why through farmer notes (e.g., “Ignored N side-dress recommendation due to excessive field wetness,” “Used different herbicide due to cost”).

Mapping Actual Input Usage: Furthermore, companies could gain insight into the full spectrum of products farmers use (including competitors’ seeds, chemicals, and biologicals logged via OCR) alongside or instead of recommended inputs, revealing real-world integrated management strategies.

Spotting Emerging Issues: Additionally, platforms could detect early patterns of new pest outbreaks, spreading diseases, or developing herbicide resistance based on aggregated farmer observations, potentially faster than traditional reporting mechanisms.

Enhancing Platform Features Through Blockchain Data Integration

Meanwhile, when farmers successfully monetize farm data with blockchain technology, precision agriculture platforms could simultaneously improve their offerings through:

Identifying Unmet Needs: Consequently, companies could analyze the types of problems farmers are frequently logging (e.g., specific nutrient deficiencies, soil compaction issues, uncommon pests) to guide the development of new platform modules, calculators, or integrations.

Improving UI/UX: Moreover, they could understand how easily farmers can log different types of data, identifying friction points in the data entry process described on the marketplace, which can inform improvements to their own platform’s interface.

Informing Integration Priorities: Additionally, seeing which other digital tools, sensor brands, or data sources farmers mention or use helps prioritize API development and strategic partnerships.

Data-Driven Marketing Revolution

Furthermore, as blockchain enables farmers to monetize farm data effectively, precision agriculture companies could transform their marketing strategies through:

Quantifiable ROI Proof: Specifically, they could leverage aggregated, anonymized data from the marketplace to demonstrate the value of specific platform features (e.g., “Analysis of 10,000 fields shows farms utilizing dynamic disease alerts and targeted fungicide applications based on platform recommendations saw a 15% reduction in disease-related losses compared to fields relying solely on calendar sprays”).

Targeted Feature Promotion: Additionally, companies could market specific modules (e.g., advanced irrigation management, soil health tracking) to regions or crop systems where marketplace data shows farmers are actively logging related challenges or inputs.

Competitive Intelligence: Moreover, platforms could understand which competitor platforms or agronomic services are being used in conjunction with specific farming practices documented on the marketplace.

Data-Driven Customer Support: Consequently, companies could anticipate common issues or questions by analyzing patterns in farmer-logged problems and observations within specific geographies or cropping systems.

Importantly, modern farms generate vast amounts of data; therefore, a single growing season can produce gigabytes or even terabytes of data per farm from sensors, machines, and imagery, underscoring the need for platforms to manage and effectively interpret this flood of data.

The Bottom Line – Smarter Tools Through Deeper Blockchain Data

Ultimately, for companies building the digital infrastructure of modern farming, access to a broad, diverse, and continuously updated stream of farmer-generated ground-truth data would be invaluable when farmers monetize farm data with blockchain solutions.

Consequently, this approach would move algorithm development beyond theoretical models and limited internal datasets into the complex reality of millions of fields.

Therefore, this blockchain-enabled data marketplace could allow precision agriculture providers to:

Build more accurate, reliable, and trustworthy predictive models.

Validate and quantify the real-world impact and ROI of their solutions.

Accelerate innovation by quickly identifying and addressing farmers’ needs.

Strengthen their competitive position with demonstrably superior insights.

In conclusion, by enabling farmers to monetize farm data with blockchain technology, precision agricultural companies could validate their algorithms, refine recommendations, and demonstrate the ROI of their platform with access to unparalleled ground-truth data.

Most importantly, it would be highly beneficial to see how real-world farmer inputs, observations, and outcomes align with designed digital models across thousands of diverse fields through this proposed blockchain marketplace

Understanding How Sprayer Manufacturers Can Monetize Equipment Data via Blockchain

For manufacturers of agricultural spraying equipment, understanding the market has traditionally involved analyzing dealer sales data. Additionally, they’ve relied on tracking warranty claims and attending industry trade shows. However, this approach is rapidly evolving.

Consider, for example, the perspective of a senior product strategy team at a major sprayer manufacturer. Their portfolio spans from simple 16-liter (approximately 4-gallon) knapsack sprayers to massive, self-propelled units. Historically, feedback on how equipment truly performed under diverse field conditions arrived slowly and incompletely.

Moreover, understanding the optimal machine configuration for a specific region, crop, and farming practice often involved educated guesswork. As a result, the critical question remained: how could they move beyond assumptions and truly engineer for real-world demands?

Importantly, for modern sprayer manufacturers, real-time agricultural data isn’t just insight—it’s becoming the ultimate competitive advantage. Through blockchain technology, this data can now be monetized effectively while maintaining transparency and security.

Traditional Sprayer Market Strategy – Limited by Sales & Service Data

Until recently, spray equipment companies have only been able to estimate how their tools are used across various global fields. Nevertheless, with blockchain-enabled real-time agricultural data, they could finally stop guessing and start making data-driven decisions.

The conventional approach relies heavily on several limited data sources:

Dealer Sales Reports: Initially, these identified best-selling models in broad territories, but lacked granular usage insights.

Warranty & Parts Data: While these indicated failure points, they unfortunately lacked operational context and real-world performance metrics.

Competitor Benchmarking: This involved analyzing published specifications, yet provided little insight into actual field performance.

Customer Surveys & Focus Groups: Although valuable, these gathered only limited-scale feedback from small sample sizes.

Anecdotal Field Feedback: Finally, insights from sales and service teams, while helpful, were often inconsistent and unverifiable.

Consequently, this system provides only a functional overview but struggles with granularity. Therefore, it remains challenging to connect design choices to real-world durability or efficiency across the full spectrum of user behaviors and field conditions.

Blockchain-Enabled Data Strategy – Transforming Usage, Wear, and Opportunity Data into Revenue

Accessing granular, real-time data through blockchain-powered agricultural trading platforms could offer sprayer manufacturers unprecedented opportunities to monetize farm data. Furthermore, this approach provides transparent, immutable records that can be monetized while protecting farmer privacy.

Deep Market Understanding & Segmentation Through Blockchain Data Monetization

Mapping Equipment Penetration & Usage: Through blockchain networks, manufacturers could precisely identify which types and sizes of sprayers are being used. For instance, data might include knapsack sprayers (e.g., 16L), tractor-mounted units (e.g., 200-liter / ~50-gal, 600-liter / ~160-gal), self-propelled models, orchard sprayers, and drone systems.

Additionally, blockchain can provide GPS coordinates (if chosen by farmer), crop data, and farm segment information. For example, data might reveal that e.g. 58% of small plot farmers in a specific Indian region rely heavily on 16L knapsacks, consequently indicating a significant market opportunity for lightweight, battery-powered upgrades.

Tracking Equipment Age & Replacement Cycles: Similarly, analyzing logged equipment age data through blockchain reveals typical lifespans and highlights upgrade opportunities. For instance, data may confirm that farms using sprayers older than 7 years incur e.g. 32% higher maintenance costs.

Regional Demand Forecasting: Furthermore, blockchain enables correlation of equipment usage with environmental data (climate conditions) and agronomic factors (pest/disease pressure). For example, high humidity data from Ghana correlating with frequent fungal outbreaks could drive targeted demand forecasting for high-pressure mist blowers.

Real-World Competitor Usage: Importantly, blockchain networks can identify specific competitor models being used, where they operate, and provide insights into their performance advantages or disadvantages through verified farmer notes and usage patterns. For instance, data might show that a rival’s specific 600L orchard sprayer dominates Italian olive groves, with further blockchain analysis revealing that its nozzle design demonstrably reduces drift.

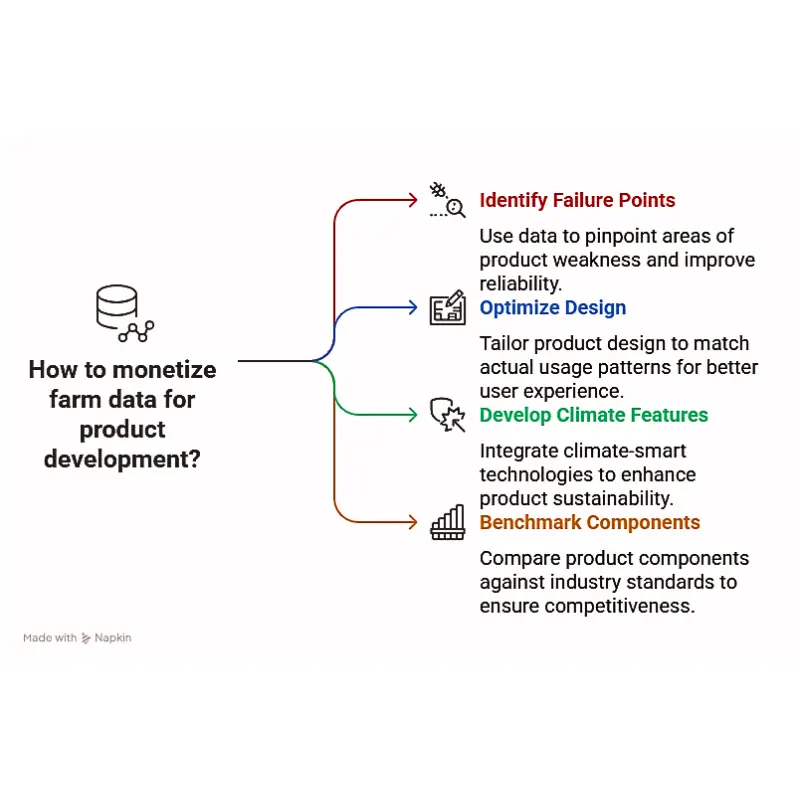

How to Monetize Farm Data for Product Development (R&D) Using Blockchain

Identifying Real-World Failure Points: Through blockchain’s immutable records, manufacturers can correlate logged maintenance status and farmer notes with specific models, age, operating conditions, and chemicals used.

Consequently, this provides critical R&D input. For example, frequent reports of pump seal failure on model ‘XZSpray12Master FR300nhuy’ when used with specific abrasive formulations become valuable, monetizable data points.

Optimizing Design for Usage Patterns: Additionally, blockchain data helps manufacturers understand exactly how equipment is used, including pressure levels, nozzle choices, tank mixing frequency, and cleaning routines. Therefore, this information becomes invaluable for improving durability, ergonomics, and efficiency while creating new revenue streams from data insights.

Developing Climate-Smart Features: Moreover, utilizing blockchain-verified regional challenge data drives innovation and informs decision-making. For instance, manufacturers can develop AI-enabled sprayers that auto-adjust pressure based on blockchain-linked pest density maps or weather data.

Similarly, they can design corrosion-resistant models specifically for coastal regions identified through blockchain data as having high salinity impact.

Benchmarking Components: Finally, analyzing farmer feedback and usage data related to specific components through blockchain networks allows manufacturers to compare efficiency rates across different types and against competitors, creating additional monetization opportunities.

Step-by-Step Guide to Monetize Farm Data with Blockchain for Marketing & Sales

In a hypothetical scenario where a blockchain-based agricultural trading platform exists, sales and marketing strategies would evolve dramatically. With access to verified, real-time farm data, manufacturers and distributors could shift from broad campaigns to precision-targeted outreach.

Below are five actionable steps that illustrate how sales and marketing teams could leverage blockchain insights to drive adoption, differentiation, and long-term value.

Step 1: Implement Micro-Targeted Campaigns First, move beyond generic advertising by using blockchain-verified data to identify specific needs. For example, promote drone sprayers specifically to farms battling steep terrain (as determined by GPS data). Alternatively, target Colombian coffee growers with compact mist blowers after blockchain data shows that 80% use outdated knapsacks on hilly terrain.

Step 2: Develop Dynamic & Value-Based Messaging Next, tailor promotions based on localized blockchain data. Specifically, highlight drift-reduction features where high winds are common, or emphasize operator comfort where long spray durations are logged. Furthermore, justify premium features with aggregated blockchain data showing improved outcomes (e.g., better coverage, reduced chemical use).

Step 3: Execute Competitor Counterplay Strategies Subsequently, identify competitor weaknesses revealed by blockchain data analysis. For instance, if data shows a rival’s sprayer struggles in high winds, launch a targeted campaign for a e.g. ‘Wind-Guard’ line featuring specialized nozzles.

Step 4: Offer Predictive Maintenance & Bundles Then, provide value-added services based on blockchain usage data, such as predictive maintenance bundles. These could utilize IoT sensors connected to blockchain networks to track wear patterns and trigger timely service or parts upsells.

Step 5: Create Customized Financing & Leasing Programs Finally, adapt offers to market realities identified through blockchain data. For example, develop specific leasing models for smallholders in Kenya, where blockchain data might show 65% of sprayers are over 8 years old and outright purchase presents a significant barrier.

Visualizing Blockchain-Powered Marketing & Sales Opportunities

Imagine dashboards that transform raw blockchain data into actionable monetization strategies:

Heat Maps: Layering sprayer age data with regional pest outbreak frequency helps prioritize areas for trade-in programs or upgrade campaigns. For instance, “High usage of 200L sprayers >7yrs old on tomatoes in Area “XY” + rising blight reports → Initiate replacement campaign in Q3.”

Trend Dashboards: Additionally, tracking adoption rates of specific technologies through blockchain networks reveals opportunities. “Demand for organic-compatible sprayers shows 18% annual growth in Europe → Increase focus on relevant product lines.” Similarly, “Drone sprayer trials rising in western Nigeria → Evaluate distribution partners immediately.”

Usage Profiles: Furthermore, segmenting market needs by specific practices through blockchain analysis identifies niche opportunities. “Surge in 16L knapsack spraying for cabbage in Area “AB” highlands → Push ergonomic small-unit series.”

The Bottom Line – From Information Leaks to Laser-Focused Revenue Generation

For agricultural sprayer manufacturers, granular agrodata would facilitate a fundamental shift from selling hardware to providing targeted application solutions. It enables companies to align R&D, marketing, and sales with verified, real-world conditions and the needs of farmers.

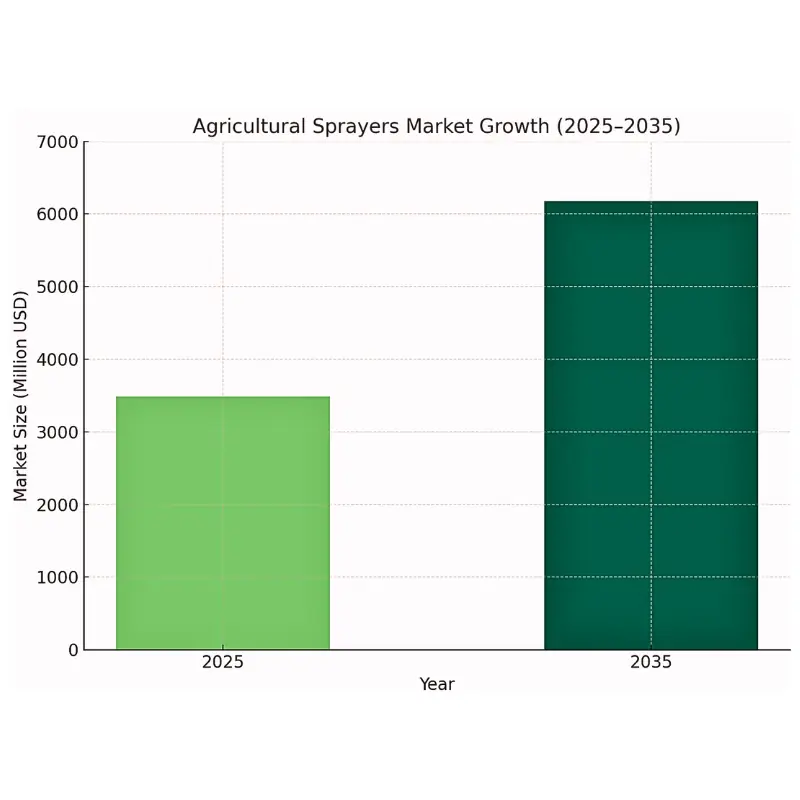

This strategic pivot is underscored by Future Market Insights, which projects the agricultural sprayers market to grow from USD 3.5 billion in 2025 to USD 6.1 billion by 2035, driven by rising demand for telematics-ready and sensor-integrated equipment.

This will lead to:

More durable, efficient, and user-centric equipment.

Reduced guesswork and waste in inventory and marketing spend.

Enhanced customer loyalty through better support and relevant products.

A more potent competitive edge built on deep market intelligence and foresight.

The future of spraying is precise. Manufacturers leveraging this data won’t just sell equipment; they’ll power Climate-Smart Cultivation.

Those who integrate verified agrodata into their sales, R&D, and product development will lead the next wave of AgTech innovation and efficiency.

Monetize Farm Data with Blockchain: Regulatory Compliance Applications

Imagine actually knowing exactly which farms have used expired herbicides or other unregistered pesticides before those harmful products enter the food chain.

For regulators and food safety auditors, indeed, blockchain-powered agrodata isn’t just about recordkeeping—rather, it is the key to preemptive governance and verifiable trust within a complex global supply chain.

Enhanced Monitoring & Proactive Risk Mitigation

To begin with, farmers can monetize farm data with blockchain by providing critical monitoring capabilities:

Mapping Pesticide Use Patterns: Initially, regulatory bodies will be able to visualize the distribution and intensity of specific active ingredient use across regions, crops, and seasons.

Subsequently, they can identify potential areas of overuse or deviations from recommended practices. As a result, this data becomes valuable to regulatory bodies seeking comprehensive oversight.

Tracking High-Risk and Banned Chemicals: Similarly, they could monitor the application frequency and geographic spread of pesticides under review or known to be of environmental concern.

Moreover, proposed blockchain trading platform could help them identify applications of banned or obsolete active ingredients that are still in use, thereby potentially pinpointing areas that require cleanup efforts.

Notably, the global stockpile of obsolete pesticides is estimated in the hundreds of thousands of tons, thus making tracking crucial for regulatory authorities.

Additionally, government agencies and scientific bodies increasingly recognize the critical role of real-world pesticide use data in regulatory decision-making.

For instance, Health Canada’s Pest Management Regulatory Agency (PMRA) is actively developing a Pesticide Use Information Framework to incorporate real-world usage data into risk assessments, exposure characterizations, and policy development.

Therefore, farmers can position themselves as valuable data providers in this evolving landscape.

Detecting Compliance Violations Through Blockchain Data

Furthermore, detecting counterfeit, illegal, and expired use presents another avenue to monetize farm data with blockchain: Specifically, anomalies in batch numbers or product names captured via OCR, cross-referenced with registration databases, can flag suspicious products in use.

Consequently, identify patterns of expired pesticide application—a significant compliance and safety issue.

For example, data might reveal that 12% of maize farmers in a region used expired glyphosate—thus shifting detection from reliance on seizures to proactive monitoring.

Environmental Risk Assessment and Targeted Monitoring

In addition, targeted environmental monitoring correlates pesticide application data with environmental layers (waterways, habitats, weather) to identify areas at higher risk for contamination.

Subsequently, this informs targeted sampling or mitigation strategies, thereby creating additional value streams for farmers’ blockchain-recorded data.

Data-Driven Enforcement & Policy Precision

Policy makers could benefit from proposed platform in different ways:

Risk-Based Inspections: Primarily, they could focus limited enforcement resources on regions, crops, or farm types showing high-risk data patterns (e.g., frequent use of flagged chemicals, unusually high application rates).

Faster Response & Dynamic Policies: Meanwhile, they could also detect potential resistance development or unexpected pest outbreaks, thus prompting unusual chemical use much earlier. Consequently, this allows for dynamic policies, potentially allowing restricted pesticides only in verified hotspot regions rather than blunt, broad bans.

Policy Impact Assessment and Registration Support

Additionally, evaluating policy impact assesses the real-world effects of restrictions or IPM programs by observing actual changes in farmer application behavior reflected in the data.

Furthermore, informing registration and labeling utilizes aggregated real-world usage data to understand how products are being applied, thereby informing label reviews and decisions on new registrations.

The Access Model – Public Good, Data Value, and Fair Compensation

However, direct government purchase of this data might face budgetary hurdles.

Nevertheless, the benefits to the public good are undeniable. Therefore, a potential solution lies in fair exchange models that help farmers monetize farm data with blockchain:

Government Subsidized Access Programs

Subsidized Access for Regulators: First and foremost, governments could negotiate free or highly subsidized access to specific, anonymized, or aggregated datasets crucial for public health and environmental safety.

Incentivizing Farmer Transparency: Instead of direct government payment to farmers for data, alternatively, compensation could be linked to participation and transparency via government programs:

Enhanced Subsidy and Benefit Structures

Enhanced Subsidy Access: Specifically, farmers opting to share verifiable spray records could qualify for expanded or prioritized access to existing or new agricultural subsidies (e.g., for organic transition, climate-smart practices, equipment upgrades). Notably, studies show subsidies can be a primary motivator for adopting new practices.

Tiered Benefits: Moreover, create levels of reward based on data shared (e.g., basic batch data earns access to seed subsidies; while detailed GPS-linked logs qualify for low-interest loans).

Compliance Rewards & Streamlining: Furthermore, achieving high data consistency can earn the “Verified Compliant” status, potentially simplifying other reporting requirements and attracting premium buyers.

Ultimately, this approach respects data ownership while fostering a collaborative ecosystem where transparency is rewarded, leading to safer practices and more effective governance.

In essence, farmers innovate, regulators safeguard; with blockchain-recorded data, these roles complement each other while enabling farmers to monetize farm data with blockchain.

The Importance of Robust Monitoring

Undoubtedly, the stakes are high: specifically, improper pesticide use contributes to crop losses, while many suffer from unintentional poisoning annually, and managing pesticide resistance incurs significant costs.

Therefore, effective, data-informed monitoring is essential for both public safety and creating sustainable revenue streams for farmers who monetize farm data with blockchain.

Reinventing Compliance: Food Safety Standards Verification and Blockchain-Enabled Digital Trust

Beyond national regulation, importantly, the blockchain agrodata platform offers powerful tools for farmers and auditors navigating the complexities of international food safety standards and market access.

Specifically, certifications like GLOBALG.A.P. (e.g., V6 Fruits and Vegetables standard) are non-negotiable for many export markets, which demand meticulous traceability of inputs, including pesticides and fertilizers. Consequently, this presents another opportunity to monetize farm data with blockchain.

From Paper Trails to Verifiable Digital Logs

Traditionally, compliance audits often involve laboriously reviewing handwritten logs, cross-referencing invoices, and inspecting storage processes that are prone to errors and require time-consuming verification.

Furthermore, studies in certain regions have revealed significant discrepancies between paper records and actual usage. However, blockchain technology transforms this landscape.

Blockchain Data as a Compliance Accelerator and Revenue Stream

Remarkably, the blockchain agrodata platform could transform this by providing a secure, efficient mechanism for verification.

Streamlined Digital Audit Processes

Digital Audit Trail & Reduced Audit Time: Primarily, farmers seeking certification can grant auditors time-limited, specific access to their identifiable records.

Subsequently, the blockchain’s immutability provides strong assurance against tampering. As a result, auditors can instantly cross-reference digital logs with physical records or farmer statements, potentially reducing audit time significantly (perhaps by up to 50%) while increasing accuracy.

Input Verification: Additionally, OCR-captured batch numbers and expiry dates directly verify the use of registered, non-expired products.

Maximum Residue Limit (MRL) Compliance and Export Market Access

MRL Compliance Support: Specifically, timestamped application records provide clear evidence for verifying adherence to Pre-Harvest Intervals (PHIs), which are crucial for meeting Maximum Residue Limits (MRLs) in export markets. For example, this is vital for trade compliance, particularly ensuring that EU-bound avocados meet residue requirements.

Real-Time Compliance Flags: Moreover, the potential for systems to flag applications inconsistent with standard requirements (e.g., the use of a chemical banned in the target export market, such as chlorpyrifos, for EU exports).

Similarly, in the United States, the USDA’s Pesticide Data Program (PDP) provides a robust example of how systematic, real-world data collection supports food safety.

Specifically, in 2022, the USDA tested 10,665 samples across 23 commodities (including foods commonly consumed by children) and found that over 99% of samples had pesticide residues below EPA benchmark levels.

The Necessity of Identifiable Data & Farmer Control

Crucially, this compliance use case would require identifiable data that links applications to a specific farm or farmer. In contrast, this differs from the anonymized and aggregated data used for broader regulatory monitoring or commercial insights.

Data Privacy and Farmer Consent Frameworks

Explicit Farmer Consent: First and foremost, the platform must ensure farmers have granular control over sharing identifiable data solely for auditing purposes with authorized bodies.

Traceability Link: Similarly, GPS coordinates or unique farm/user IDs are essential for the auditor to verify the origin of the data. While personal data remains protected, nevertheless, geospatial tags are key.

.

Value Creation for Farmers Through Blockchain Compliance

Farmer Value: Ultimately, the benefit is streamlined audits, reduced paperwork, enhanced credibility, easier demonstration of compliance, unlocking of potential new government subsidies and facilitated access to premium markets.

Furthermore, this digitally verifiable system builds consumer trust (potentially influencing purchasing decisions, as surveys suggest strong consumer preference for verified safety claims) and transforms compliance into a proactive partnership that enables farmers to monetize farm data with blockchain.

In conclusion, by having access to this kind of blockchain trading platform, farmers can leverage verified, real-time agrodata to move beyond reactive enforcement.

Specifically, it can enable targeted oversight, streamline audits, reward farmer transparency, and build digitally verifiable trust from farm to fork while creating sustainable revenue opportunities for those who choose to monetize farm data with blockchain.

How Farmers Can Monetize Farm Data with Blockchain: Insurance Risk Solutions

What if insurance payouts triggered automatically the moment a verified pest outbreak hits your region—no claims, no delays? Furthermore, imagine if policies priced themselves based on your actual soil health data?

Consequently, for insurers and farmers alike, blockchain and granular agrodata aren’t just tools—they’re the antidote to a system often plagued by basis risk and mistrust.

Additionally, the agricultural insurance industry plays a vital role in stabilizing farm incomes against the growing threat of weather extremes and other perils, risks increasingly amplified by climate change. For instance, consider the viewpoint of a seasoned actuary or underwriter within a leading agricultural insurance firm.

Typically, their world revolves around assessing risk, setting premiums, and processing claims, often relying on historical regional averages, sparse weather station data, and sometimes costly farm visits.

However, while index-based insurance emerged to combat issues like moral hazard found in traditional indemnity products, unfortunately, it introduced its significant challenge: basis risk – the mismatch between index measurements and actual farm losses.

Therefore, for insurers, blockchain-powered agrodata would not be just a tool—it’s potentially the antidote to a system where basis risk often wins.

Let’s explore how agricultural insurance companies could leverage a blockchain-powered farm data exchange—if such a platform were available.

Step 1: Understanding Traditional Insurance Barriers to Farm Data Monetization

Before exploring how to monetize farm data with blockchain, it’s crucial to understand the existing challenges. Currently, the agricultural insurance landscape faces inherent challenges:

Legacy Insurance Models That Limit Data Value

Indemnity-Based Insurance Issues: Primarily, these systems are prone to asymmetric information (adverse selection, moral hazard), requiring costly loss assessments, and struggling with insuring unmeasurable outputs.

Index-Based Insurance Issues: Similarly, these suffer from basis risk (spatial, temporal, design), where simple indices (like rainfall alone) fail to capture the true complexity of farm-level outcomes, consequently potentially leaving farmers unprotected against actual losses (e.g., pest devastation despite adequate rainfall). Additionally, slow payouts (often 60-90 days or more) can also significantly impact a farmer’s liquidity.

Step 2: Leveraging Blockchain Agrodata Platforms to Monetize Farm Data

To overcome these limitations, accessing granular, real-time, multi-layered data from blockchain-powered agrodata trading platforms could offer a powerful solution, simultaneously enhancing both traditional and index-based models:

Converting Farm Practices into Valuable Data Assets